Are you ready to take control of your financial future and build lasting wealth? This comprehensive guide to wealth management provides essential strategies for securing your financial well-being. Learn how to effectively manage your investments, plan for retirement, protect your assets, and achieve your long-term financial goals. Discover proven techniques for wealth preservation and growth, empowering you to build a secure and prosperous future.

What is Wealth Management and Why It Matters

Wealth management is a comprehensive approach to financial planning that goes beyond simply investing. It involves a holistic strategy encompassing all aspects of a client’s financial life, aiming to grow, preserve, and transfer wealth across generations.

Why does it matter? Effective wealth management provides financial security and peace of mind. It helps individuals and families achieve their financial goals, whether that’s securing retirement, funding education, or leaving a legacy. A well-structured plan can mitigate risks, optimize investment returns, and ensure your financial future is aligned with your personal values and aspirations.

Key elements often included in wealth management strategies are: financial planning, investment management, tax planning, estate planning, and risk management. A professional wealth manager can provide personalized guidance and expertise to navigate these complexities.

How to Develop a Long-Term Financial Plan

Developing a long-term financial plan is crucial for securing your financial future. It involves setting clear, measurable, achievable, relevant, and time-bound (SMART) goals. Begin by assessing your current financial situation, including assets, liabilities, and income.

Next, define your financial goals. These might include retirement planning, purchasing a home, funding your children’s education, or simply building wealth. Prioritize these goals based on your timeline and importance.

Create a budget that aligns with your goals. Track your spending to identify areas where you can save and allocate funds towards your objectives. Consider using budgeting apps or spreadsheets to simplify this process.

Invest wisely based on your risk tolerance and time horizon. Diversification is key to mitigating risk. Consider consulting a financial advisor for personalized investment advice.

Regularly review and adjust your plan as your circumstances change. Life throws curveballs, so flexibility is essential. Reassess your goals, budget, and investment strategy at least annually or whenever significant life events occur.

Finally, protect your assets with adequate insurance coverage, including health, life, disability, and property insurance. This safeguards your financial well-being against unexpected events.

The Role of Diversification in Wealth Protection

Diversification is a cornerstone of effective wealth protection. It involves spreading investments across different asset classes (stocks, bonds, real estate, commodities, etc.) and geographies to mitigate risk. By not putting all your eggs in one basket, you reduce the impact of any single investment performing poorly.

Reducing volatility is a key benefit of diversification. If one asset class experiences a downturn, others may perform well, offsetting potential losses. This helps to smooth out returns over time and protect your overall portfolio value.

The level of diversification needed depends on individual circumstances, risk tolerance, and financial goals. A well-defined investment strategy, ideally developed with a financial advisor, is crucial for determining the optimal mix of assets for your portfolio.

Ultimately, diversification is a proactive measure to protect your wealth from unexpected market fluctuations and unforeseen events. It is a vital component of a robust long-term wealth management strategy.

How to Reduce Taxes on Investments

Minimizing your tax liability on investments is a crucial aspect of wealth management. Tax-advantaged accounts, such as 401(k)s and IRAs, offer significant benefits by allowing pre-tax contributions or tax-deferred growth. Understanding the nuances of these accounts is key to maximizing their potential.

Tax-loss harvesting is another effective strategy. This involves selling investments that have lost value to offset capital gains taxes. Careful planning and consideration of the wash-sale rule are crucial for successful implementation.

Diversification across various asset classes can also help reduce your overall tax burden. Certain investments, like municipal bonds, offer tax-exempt income, providing a pathway to lower taxable income.

Consult with a qualified financial advisor. They can help you develop a comprehensive tax-efficient investment strategy tailored to your specific financial situation and goals, considering your risk tolerance and long-term objectives. Professional guidance is vital for navigating the complexities of tax laws and maximizing your investment returns while minimizing tax liabilities.

The Importance of Retirement Planning

Retirement planning is a critical component of overall wealth management. It ensures financial security during your later years, a period when your earned income typically ceases.

Adequate planning allows you to maintain your desired lifestyle, cover healthcare expenses, and enjoy leisure activities without financial stress. Failing to plan can lead to significant hardship and dependence on others.

Effective retirement planning involves several key steps: defining your retirement goals (lifestyle, expenses), estimating your retirement needs (considering inflation), and developing a savings and investment strategy to meet those needs. This may include utilizing retirement accounts such as 401(k)s and IRAs.

Regularly reviewing and adjusting your plan as needed, considering factors like changes in health, market conditions, and personal circumstances, is crucial for long-term success. Seeking professional financial advice can provide valuable guidance and support throughout the process.

In essence, proactive retirement planning provides peace of mind, knowing that your financial future is secure, allowing you to enjoy a comfortable and fulfilling retirement.

How to Leverage Real Estate for Wealth Building

Real estate offers a powerful avenue for wealth building through various strategies. Rental income provides a consistent cash flow, while property appreciation increases your asset’s value over time. Careful selection of properties in high-growth areas maximizes both income and appreciation potential.

Leverage is a key component. Using mortgages allows you to control valuable assets with a relatively smaller initial investment, magnifying returns. However, responsible debt management is crucial to avoid financial strain. Understanding market trends and local regulations is essential for making informed investment choices.

Beyond simple buy-and-hold strategies, consider value-add investing, improving properties to increase rental income or resale value. Real estate investment trusts (REITs) offer another avenue for diversification and passive income, requiring less direct involvement in property management.

Tax advantages associated with real estate investments, such as depreciation deductions, can significantly enhance your overall return. However, it’s vital to consult with a tax professional to navigate these complexities effectively. Thorough due diligence, including property inspections and market research, is paramount before any investment decision.

Building a robust real estate portfolio requires patience, discipline, and a long-term perspective. Successful wealth building in real estate demands a combination of strategic planning, financial literacy, and a willingness to adapt to evolving market conditions.

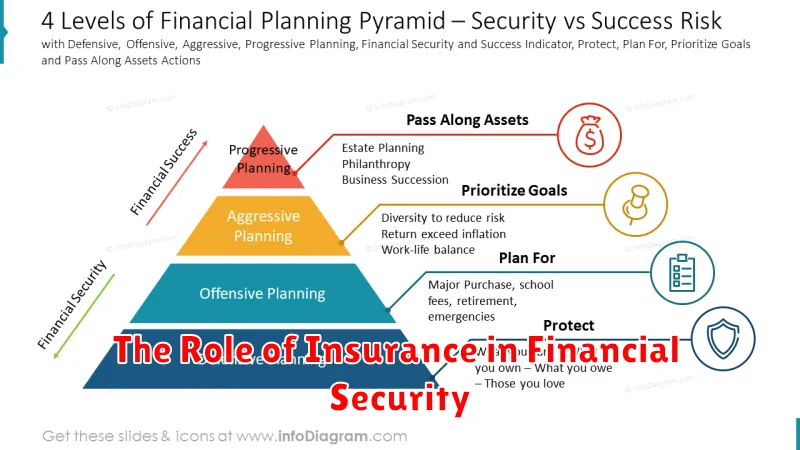

The Role of Insurance in Financial Security

Insurance plays a crucial role in securing your financial future by mitigating the risks of unforeseen events. Protecting your assets is paramount, and insurance provides a safety net against significant financial losses.

Various types of insurance address specific needs. Health insurance protects against medical expenses, life insurance safeguards your loved ones’ financial well-being in the event of your death, and property insurance covers damages to your home or belongings.

Adequate insurance coverage ensures financial stability during challenging times, preventing you from depleting savings or accumulating debt to cover unexpected costs. This proactive approach contributes significantly to long-term financial security.

Careful planning is essential. Determining the right level of coverage for each type of insurance is critical based on your individual risk profile, assets, and financial goals. Consulting with a financial advisor can help you create a comprehensive insurance plan tailored to your unique circumstances.

How to Create a Legacy Through Estate Planning

Estate planning is crucial for securing your financial future and creating a lasting legacy. It involves strategically planning for the distribution of your assets after your death or incapacity. This ensures your wishes are respected and your loved ones are provided for.

Key components of effective estate planning include: drafting a will to specify how your assets will be distributed; establishing a trust to manage assets and protect beneficiaries; designating beneficiaries for retirement accounts and life insurance policies; and planning for potential incapacity through durable power of attorney and healthcare directives.

Careful consideration should be given to tax implications, minimizing potential estate taxes through strategies like gifting and charitable giving. Professional guidance from an estate planning attorney or financial advisor is highly recommended to navigate the complexities of estate law and develop a personalized plan.

By proactively engaging in estate planning, you can not only safeguard your family’s financial well-being but also leave a positive and lasting impact on future generations, ensuring your legacy extends far beyond your lifetime. A well-structured plan provides peace of mind knowing your affairs are in order and your wishes will be fulfilled.