Understanding Real Estate Investment Trusts (REITs) is crucial for any investor seeking diversification and passive income. This comprehensive guide will delve into the intricacies of REIT investing, exploring various REIT types, including equity REITs and mortgage REITs, and examining the benefits and risks associated with this popular investment vehicle. Learn how REITs can contribute to a robust portfolio and uncover the key factors to consider before investing in this dynamic sector of the real estate market.

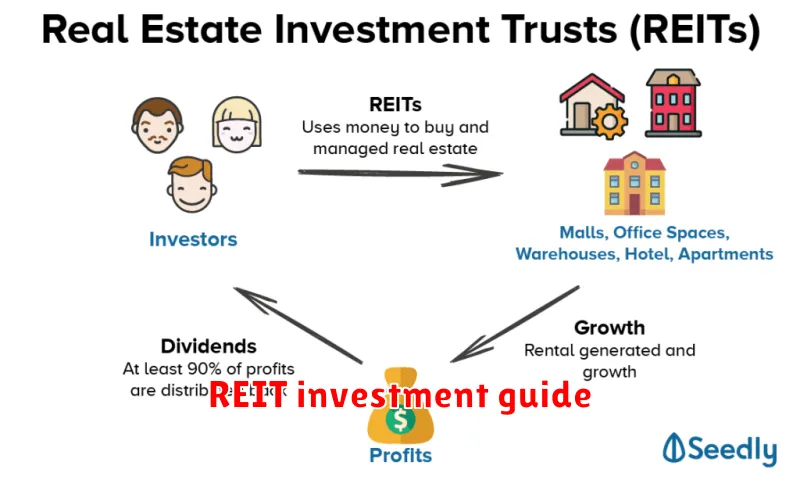

What is a REIT and How Does It Work?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-producing real estate. These properties can range from office buildings and apartments to hotels and shopping centers.

REITs operate under a specific tax structure. To qualify as a REIT, a company must meet certain requirements, including distributing a significant portion of its taxable income to shareholders as dividends. This distribution is a key characteristic of REITs.

How REITs work involves pooling capital from numerous investors to purchase and manage large-scale real estate assets. Investors purchase shares of the REIT, effectively owning a portion of the underlying real estate portfolio. The REIT then generates income through rent, property appreciation, and other real estate-related activities. This income is then passed on to shareholders in the form of dividends.

There are several types of REITs, each specializing in a particular sector of the real estate market. Equity REITs own and operate properties, generating income primarily from rents. Mortgage REITs lend money to real estate developers or other entities, earning income through interest payments. Hybrid REITs combine aspects of both equity and mortgage REITs.

Investing in REITs offers investors diversification and liquidity, as REIT shares are traded on major stock exchanges. However, as with any investment, REITs carry inherent risks, including market fluctuations and the performance of the underlying real estate market.

The Advantages of Investing in REITs

Investing in Real Estate Investment Trusts (REITs) offers several key advantages. A primary benefit is diversification; REITs allow investors to gain exposure to a diverse portfolio of real estate properties without the significant capital outlay or management responsibilities associated with direct property ownership.

REITs also provide a relatively stable income stream. Many REITs are required to distribute a significant portion of their taxable income as dividends, leading to potentially higher dividend yields compared to other investment options. This makes them attractive to income-seeking investors.

Another advantage is liquidity. Unlike direct real estate investments, REITs are traded on major stock exchanges, allowing for relatively easy buying and selling of shares. This enhances accessibility and flexibility for investors.

Furthermore, REITs offer professional management. Investors benefit from the expertise of experienced real estate professionals who handle property acquisition, management, and maintenance, eliminating the need for direct involvement in these often complex tasks.

Finally, REITs can provide inflation hedging. Real estate values tend to rise with inflation, offering a potential safeguard against the erosion of purchasing power.

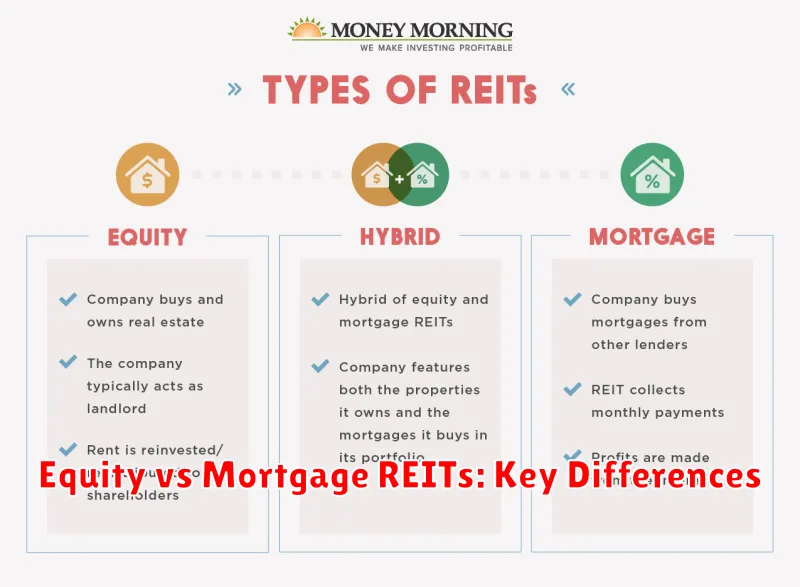

Equity vs Mortgage REITs: Key Differences

Real Estate Investment Trusts (REITs) are broadly categorized into two main types: equity REITs and mortgage REITs. Understanding their key differences is crucial for investors.

Equity REITs invest directly in income-producing real estate properties such as apartments, office buildings, shopping centers, and hotels. They generate returns primarily through rental income and property appreciation.

Mortgage REITs, on the other hand, do not own properties directly. Instead, they invest in mortgage-backed securities and other mortgage-related assets. Their returns are derived from interest income on these loans and the appreciation of the mortgage-backed securities.

A key difference lies in their risk profiles. Equity REITs are generally subject to higher levels of property-specific risk, such as tenant defaults and property maintenance costs. Mortgage REITs face interest rate risk and credit risk associated with the underlying mortgages.

Investment strategies also differ significantly. Equity REITs focus on property selection and management, while mortgage REITs concentrate on analyzing the creditworthiness of borrowers and managing their interest rate exposure. The return profiles also differ, with equity REITs offering a blend of income and potential capital appreciation, while mortgage REITs may offer a higher yield, but with greater interest rate sensitivity.

Ultimately, the choice between equity and mortgage REITs depends on an investor’s risk tolerance, investment goals, and market outlook.

How REITs Generate Passive Income for Investors

Real Estate Investment Trusts (REITs) generate passive income for investors primarily through dividend payouts. REITs are required by law to distribute at least 90% of their taxable income to shareholders as dividends. This is a key feature distinguishing REITs from other investment vehicles.

This income stream is derived from the underlying real estate assets owned by the REIT. These assets can include a diverse range of properties such as office buildings, apartment complexes, shopping centers, or even data centers. The REIT generates rental income from these properties, and after covering operational expenses, the remaining profits are distributed to investors.

The frequency and amount of dividend payments vary depending on the specific REIT and its performance. Some REITs pay dividends monthly, while others pay quarterly. Dividend yields can also fluctuate based on market conditions and the REIT’s success in managing its assets.

It’s important to note that while REIT dividends can offer a substantial passive income stream, they are not guaranteed. The amount and consistency of dividends are subject to the REIT’s financial performance and overall market conditions. Investors should conduct thorough research before investing in any REIT.

How to Choose the Best REITs for Your Portfolio

Selecting the right REITs requires careful consideration of several key factors. First, define your investment goals. Are you seeking high dividend yields, capital appreciation, or a blend of both? This will guide your REIT selection.

Next, analyze the underlying real estate sector. REITs specialize in various sectors, such as residential, commercial, industrial, or healthcare. Understanding market trends within your chosen sector is crucial. Diversification across different property types and geographic locations can mitigate risk.

Financial strength is paramount. Examine the REIT’s financial statements, paying attention to key metrics like occupancy rates, debt-to-equity ratios, and funds from operations (FFO). A strong balance sheet indicates a more stable investment.

Furthermore, assess the management team’s track record and their overall strategy. A competent management team is essential for long-term success. Finally, compare valuation metrics such as price-to-FFO ratios to identify undervalued opportunities. Remember to conduct thorough research before investing in any REIT.

The Role of REITs in Portfolio Diversification

Real Estate Investment Trusts (REITs) offer a unique opportunity to enhance portfolio diversification. REITs provide exposure to the real estate market, a sector often exhibiting low correlation with traditional asset classes like stocks and bonds.

This low correlation is crucial for diversification. When stocks and bonds underperform, real estate, and consequently REITs, may offer stability or even growth, mitigating overall portfolio risk. This reduced volatility stems from the different economic drivers affecting real estate versus stocks and bonds.

Furthermore, the liquidity of REITs allows for relatively easy entry and exit compared to direct real estate investment. Investors can efficiently adjust their exposure to the real estate sector as market conditions change, providing a dynamic element to their diversification strategy.

By incorporating REITs, investors can potentially achieve a more balanced portfolio with reduced risk and potentially enhanced returns over the long term. The specific proportion of REITs will depend on individual risk tolerance and investment goals.

Tax Benefits and Risks of Investing in REITs

REITs offer significant tax advantages. Qualified REIT dividends are taxed at a lower rate than ordinary income, benefiting investors. Furthermore, REITs generally don’t pay corporate income tax if they meet certain distribution requirements. This pass-through nature of taxation can lead to significant tax savings compared to direct real estate investments.

However, investing in REITs also presents tax risks. While dividends are taxed favorably, any capital gains realized from selling REIT shares are subject to the usual capital gains tax rates. Unrelated business taxable income (UBTI) can also arise if a REIT engages in certain activities outside its core real estate business, leading to unexpected tax liabilities for investors. Careful consideration of these aspects is crucial for effective tax planning.

Understanding the specific tax implications of your REIT investments is vital. Consult with a qualified tax professional to assess your individual situation and explore potential tax optimization strategies relevant to your portfolio composition and risk tolerance. Proper tax planning can maximize the benefits while mitigating potential risks associated with REIT investments.

How to Invest in REITs Through ETFs and Mutual Funds

Investing in Real Estate Investment Trusts (REITs) offers diversification and potential for income generation, but direct investment can be complex. Exchange-Traded Funds (ETFs) and Mutual Funds provide convenient and cost-effective access to a diversified portfolio of REITs.

REIT ETFs trade on stock exchanges like individual stocks, offering intraday liquidity. They provide instant diversification across various REIT sectors (e.g., residential, commercial, healthcare). Investors can buy and sell shares throughout the trading day, mirroring the ease of stock trading. Consider factors like expense ratio and portfolio diversification when selecting a REIT ETF.

REIT Mutual Funds are actively or passively managed portfolios of REITs. Actively managed funds aim to outperform the market, while passively managed funds track a specific index. Mutual funds typically have higher minimum investment requirements than ETFs and may not offer intraday trading. Investors should evaluate the fund’s investment strategy, expense ratio, and past performance.

Both ETFs and mutual funds offer a simplified approach to REIT investing, minimizing the complexities associated with direct ownership. However, understanding your investment goals and risk tolerance is crucial before selecting either option. Consulting with a financial advisor is recommended for personalized guidance.