Building a profitable investment portfolio requires a well-defined investment strategy. This article explores various investment strategies to help you achieve your financial goals, covering topics such as risk management, portfolio diversification, and the selection of high-yield investments. Learn how to navigate the complexities of the market and make informed decisions to maximize your returns and build long-term wealth through effective portfolio management.

The Importance of Setting Investment Goals

Setting clear investment goals is paramount to building a profitable portfolio. Without defined objectives, your investment strategy lacks direction, making it difficult to measure success and stay motivated.

Specific goals, such as retirement planning, purchasing a home, or funding your children’s education, provide a roadmap for your investment decisions. They dictate your risk tolerance, investment timeline, and asset allocation.

Measurable goals allow you to track your progress and make necessary adjustments along the way. Regularly reviewing your portfolio’s performance against your goals ensures you stay on track and make informed decisions.

Achievable goals are realistic and attainable within your timeframe and financial capacity. Setting overly ambitious goals can lead to frustration and poor investment choices.

Finally, time-bound goals create a sense of urgency and accountability. Knowing your target date helps you prioritize investments and make strategic decisions based on your timeline.

In essence, well-defined investment goals provide the foundation for a successful and profitable investment journey. They guide your decisions, help you stay focused, and ultimately increase your chances of achieving your financial objectives.

How to Choose the Right Asset Allocation

Asset allocation is the cornerstone of successful investing. It involves determining the proportion of your portfolio invested in different asset classes, such as stocks, bonds, real estate, and cash.

The optimal allocation depends heavily on your individual risk tolerance, investment timeframe, and financial goals. A younger investor with a longer time horizon may tolerate more risk and allocate a larger percentage to stocks, aiming for higher long-term growth. Conversely, an investor nearing retirement might prioritize capital preservation and allocate a larger portion to bonds for stability.

Consider your risk profile. A conservative investor prefers lower risk and potential returns, opting for a higher allocation to bonds and cash. A moderate investor seeks a balance between risk and return, diversifying across several asset classes. An aggressive investor is willing to accept higher risk for potentially greater returns, with a larger allocation to stocks.

Diversification is crucial. Spreading investments across different asset classes helps to mitigate risk. No single asset class consistently outperforms, and diversification helps cushion losses during market downturns.

Rebalancing your portfolio periodically is essential to maintain your target asset allocation. As market values fluctuate, your portfolio’s proportions may drift from your initial plan. Rebalancing involves selling some assets that have grown beyond their target allocation and buying others that have fallen below.

Seeking professional advice from a qualified financial advisor can be invaluable. They can help you assess your risk tolerance, define your financial goals, and develop a personalized asset allocation strategy tailored to your specific circumstances.

Risk vs Reward: Understanding Investment Trade-offs

Investing inherently involves a trade-off between risk and reward. Higher potential returns typically come with higher levels of risk.

Risk refers to the possibility of losing some or all of your invested capital. This can stem from various factors including market volatility, company performance, or unforeseen economic events.

Reward, on the other hand, represents the potential profit or return on your investment. This could be in the form of capital appreciation, dividends, or interest.

Understanding your own risk tolerance is crucial. Conservative investors might prefer lower-risk investments like bonds or savings accounts, accepting lower potential returns for greater security. Aggressive investors, comfortable with higher risk, may opt for stocks or other high-growth investments with the potential for significant gains but also substantial losses.

Diversification is a key strategy to manage risk. By spreading investments across different asset classes, you reduce the impact of any single investment performing poorly.

Ultimately, the optimal balance between risk and reward is subjective and depends on individual financial goals, time horizon, and risk tolerance. A well-defined investment strategy should carefully consider this fundamental trade-off.

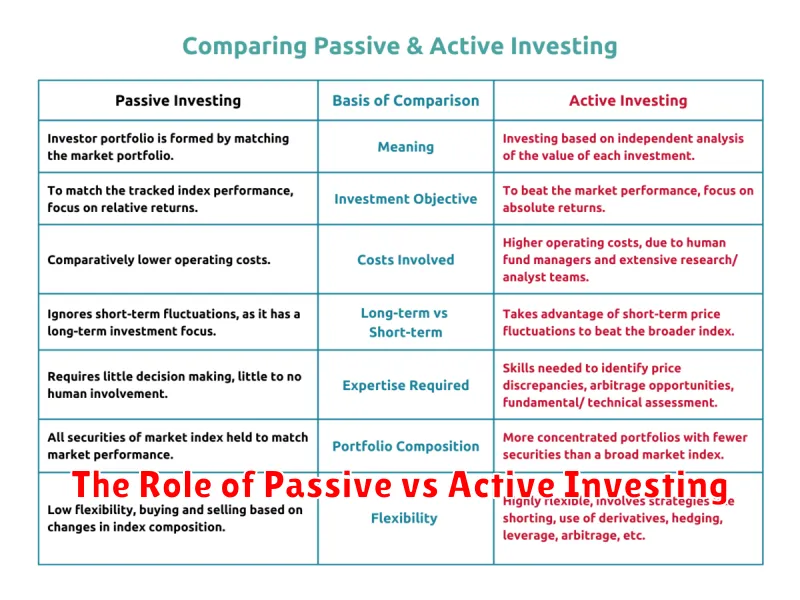

The Role of Passive vs Active Investing

Passive investing involves buying and holding a diversified portfolio of assets, such as index funds or ETFs, mirroring a specific market index. This strategy minimizes trading costs and relies on the long-term growth of the market.

In contrast, active investing requires a more hands-on approach. Active investors actively select individual stocks or bonds, aiming to outperform the market by identifying undervalued assets or predicting market trends. This strategy involves higher transaction costs and demands more time and expertise.

The choice between passive and active investing depends on individual circumstances and investment goals. Passive investing is generally preferred by those seeking a low-cost, low-maintenance approach, while active investing may suit investors with the time, knowledge, and risk tolerance to potentially achieve higher returns, though with a higher risk of underperformance.

Ultimately, a successful investment strategy often considers a blend of both approaches, tailoring the mix to align with the investor’s risk tolerance, financial goals, and time horizon.

How to Hedge Against Market Volatility

Market volatility can significantly impact investment returns. To mitigate risk, consider employing hedging strategies. These strategies aim to reduce potential losses during market downturns.

One common approach is diversification. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces reliance on any single market’s performance. This minimizes the impact of a downturn in one sector.

Hedging with derivatives, such as options or futures contracts, can offer protection against specific market movements. For instance, purchasing put options on a stock portfolio can limit losses if the market declines.

Investing in inverse ETFs (exchange-traded funds) is another option. These funds profit when the underlying market index falls, offering a counterbalance to a declining portfolio.

Gold is often considered a safe haven asset. Its price tends to rise during times of economic uncertainty, acting as a hedge against inflation and market volatility.

Cash provides liquidity and stability. Holding a portion of your portfolio in cash allows you to take advantage of market dips or simply weather short-term volatility.

It’s crucial to remember that no hedging strategy guarantees profit. The effectiveness of a hedge depends on market conditions and the specific strategy employed. Consult a financial advisor to determine the best hedging approach for your individual investment goals and risk tolerance.

Rebalancing Your Portfolio for Maximum Growth

Rebalancing your investment portfolio is a crucial strategy for maximizing growth and mitigating risk. It involves periodically adjusting your asset allocation to maintain your target percentages across different asset classes (e.g., stocks, bonds, real estate).

As market fluctuations occur, some investments will outperform others, causing your portfolio to drift from its original allocation. Rebalancing involves selling some of your overperforming assets and reinvesting the proceeds into underperforming ones. This helps to capitalize on market downturns by purchasing assets at lower prices and to avoid excessive exposure to any single asset class.

The frequency of rebalancing depends on your investment goals and risk tolerance. Some investors rebalance annually, while others do so quarterly or even semi-annually. A well-defined rebalancing strategy should be a core component of your overall investment plan.

Benefits of rebalancing include improved risk management, increased diversification, and the potential for higher long-term returns by taking advantage of market cycles. However, it’s important to note that rebalancing involves transaction costs, which should be considered.

Implementing a rebalancing strategy requires discipline and a clear understanding of your investment objectives. Consulting with a financial advisor can be beneficial in determining the appropriate rebalancing schedule and asset allocation for your individual circumstances.

The Impact of Inflation on Investments

Inflation significantly impacts investment returns. When prices rise, the purchasing power of your money decreases. This means that even if your investments grow in nominal terms, their real return – the growth adjusted for inflation – may be lower or even negative.

Different investment types react differently to inflation. Fixed-income investments, such as bonds, generally suffer during inflationary periods because their yields may not keep pace with rising prices. Equities, or stocks, can offer better inflation protection as companies can often pass increased costs onto consumers, but their performance isn’t guaranteed.

Real estate can sometimes serve as a hedge against inflation, as property values tend to rise along with overall prices. However, this isn’t always the case and depends on various market factors. Commodities, like gold and oil, are also often considered inflation hedges, but their prices can be highly volatile.

To mitigate the impact of inflation, investors should consider diversifying their portfolios across different asset classes and include inflation-resistant investments. Regular portfolio rebalancing and adjusting the allocation based on inflation expectations is crucial. Furthermore, understanding your risk tolerance and investment timeframe is paramount in crafting an effective inflation-conscious investment strategy.

Common Investment Myths and How to Avoid Them

Investing wisely requires dispelling common myths that can hinder financial success. One prevalent myth is that timing the market is key. This is false; consistently investing over time, regardless of short-term market fluctuations (dollar-cost averaging), is far more effective.

Another misconception is that higher risk always equals higher returns. While higher potential returns often correlate with greater risk, it’s crucial to diversify your portfolio and align your investment strategy with your risk tolerance. Don’t chase high returns blindly; focus on sustainable growth.

The belief that past performance predicts future results is also misleading. While past performance is informative, it’s not a guarantee of future success. Thoroughly research potential investments and understand their inherent risks before committing your capital.

Finally, many believe that professional help is unnecessary. While self-directed investing is possible, seeking guidance from a qualified financial advisor can provide valuable insights and personalized strategies, especially for complex investment situations.

By understanding and avoiding these common myths, investors can significantly improve their chances of building a profitable and sustainable investment portfolio.