Effectively managing investment risks is crucial for building and protecting a thriving portfolio. This article will explore proven strategies to mitigate financial risk, offering actionable steps to safeguard your investments and achieve your long-term financial goals. We’ll cover diverse risk management techniques, including diversification, asset allocation, and understanding your personal risk tolerance, empowering you to make informed decisions and navigate the complexities of the investment landscape with confidence.

Understanding Different Types of Investment Risks

Investing inherently involves risk. Understanding the various types is crucial for effective portfolio management. These risks can broadly be categorized as:

Market Risk: This refers to the potential for losses due to broad market fluctuations. Factors like economic downturns, geopolitical events, and investor sentiment can significantly impact asset prices.

Credit Risk: This risk is associated with the possibility of a borrower defaulting on a debt obligation. This is particularly relevant for investments in bonds and loans.

Liquidity Risk: This is the risk that an asset cannot be easily bought or sold without significantly impacting its price. Less liquid assets may be harder to sell quickly when needed.

Inflation Risk: This is the risk that the purchasing power of your investments will erode due to rising inflation. This is a significant concern during periods of high inflation.

Interest Rate Risk: Changes in interest rates can affect the value of fixed-income investments like bonds. Rising rates generally decrease bond prices.

Operational Risk: This encompasses the risks associated with the internal processes of an investment firm or the management of your own portfolio. Errors, fraud, or inadequate security measures can lead to losses.

Diversification is key to mitigating these risks. By spreading investments across different asset classes, geographies, and sectors, you reduce the impact of losses in any single area.

How to Diversify Your Portfolio Effectively

Effective portfolio diversification is crucial for mitigating risk. It involves spreading your investments across different asset classes, reducing the impact of poor performance in any single area.

Asset Allocation is the cornerstone of diversification. Consider a mix of stocks (equities), bonds (fixed income), and alternative investments like real estate or commodities. The optimal allocation depends on your risk tolerance, time horizon, and financial goals. Generally, younger investors with longer time horizons can tolerate more risk and allocate a higher percentage to stocks.

Geographic Diversification expands beyond asset classes. Investing in companies and assets from different countries reduces exposure to regional economic downturns. A global perspective can provide opportunities for growth and stability.

Sector Diversification means spreading investments across various industry sectors. Concentrating investments in a single sector (e.g., technology) exposes you to significant risk if that sector underperforms. A diverse portfolio includes various sectors, hedging against sector-specific risks.

Regular Rebalancing is essential. Market fluctuations will cause your portfolio’s asset allocation to drift over time. Rebalancing involves periodically adjusting your investments to return to your target allocation, ensuring your risk profile remains consistent with your goals.

Professional Advice can be invaluable, especially for complex portfolios. A financial advisor can help you develop a diversified strategy tailored to your individual circumstances and risk tolerance.

The Importance of Stop-Loss Strategies in Trading

Implementing a stop-loss strategy is crucial for managing investment risks and protecting your portfolio. A stop-loss order automatically sells an asset when it reaches a predetermined price, limiting potential losses.

The primary benefit is risk control. Without a stop-loss, a single bad trade could wipe out significant portions of your capital. Stop-losses prevent such catastrophic scenarios by setting a defined maximum loss per trade.

Emotional discipline is another key advantage. Stop-losses help remove emotion from trading decisions, preventing impulsive actions based on fear or greed that often lead to further losses. They allow investors to stick to a plan regardless of market fluctuations.

Preservation of capital is paramount. While stop-losses don’t guarantee profits, they significantly reduce the risk of substantial losses, allowing you to survive market downturns and remain in the game to capitalize on future opportunities. This is especially important for long-term investment success.

Choosing the right stop-loss level requires careful consideration of your risk tolerance and the asset’s volatility. While overly tight stop-losses may lead to frequent exits from profitable trades, overly loose ones negate the strategy’s protective effect. Properly implemented, stop-loss orders are an essential tool in any investor’s arsenal.

Hedging Strategies to Reduce Market Volatility

Market volatility can significantly impact investment portfolios. Hedging is a risk management strategy designed to reduce potential losses from adverse price movements. Several strategies exist, each with varying levels of complexity and cost.

One common approach involves using derivatives such as options or futures contracts. Buying put options, for example, provides the right, but not the obligation, to sell an asset at a specific price, limiting potential downside risk. Similarly, shorting futures contracts can offset potential losses in a long position in the underlying asset.

Another method is through diversification. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and geographical regions reduces reliance on any single market’s performance. This lowers overall portfolio volatility.

Currency hedging is crucial for international investors. It mitigates the risk of losses arising from fluctuations in exchange rates. This can be achieved through forward contracts or options on currencies.

Inverse ETFs offer a more sophisticated approach. These funds aim to deliver returns opposite to a specific market index, acting as a hedge against declines in that market. However, understanding the intricacies of these instruments is vital before employing them.

Ultimately, the optimal hedging strategy depends on individual investment goals, risk tolerance, and the specific market conditions. Careful consideration and potentially professional financial advice are essential before implementing any hedging strategy.

The Role of Bonds in Risk Management

Bonds play a crucial role in mitigating investment risk within a diversified portfolio. Unlike stocks, which are subject to significant price fluctuations, bonds generally offer more stability and predictability. This is because bond prices are less volatile than stock prices, particularly when interest rates are stable.

Their fixed-income nature provides a reliable stream of income, acting as a buffer against losses incurred in other, more volatile asset classes. This helps to reduce overall portfolio volatility and smooth returns over time. Furthermore, bonds often exhibit a negative correlation with stocks; when stock prices fall, bond prices may rise, offering a degree of portfolio protection during market downturns.

The inclusion of bonds in a portfolio allows investors to achieve a better risk-adjusted return. By diversifying across asset classes, investors can reduce their exposure to individual stock risks and achieve a more balanced investment strategy. The specific type and proportion of bonds in a portfolio should depend on an investor’s risk tolerance and overall investment goals. Careful consideration of bond maturity, credit quality, and interest rate risk is critical for effective risk management.

How Market Cycles Affect Investment Risks

Understanding market cycles is crucial for managing investment risks. Market cycles, characterized by periods of expansion and contraction, significantly influence investment returns and volatility. During bull markets, characterized by rising prices and investor optimism, risks are often perceived as lower, leading to increased investment. However, this period can also breed overvaluation and increased vulnerability to a subsequent downturn.

Conversely, bear markets, marked by falling prices and widespread pessimism, present heightened risks. Investment losses can be substantial, and investor sentiment can lead to panic selling, exacerbating the decline. The duration and severity of these cycles vary, making precise prediction impossible. Therefore, a diversified portfolio and a long-term investment strategy are crucial to mitigate risks associated with market fluctuations.

Risk tolerance is a key factor. Investors with a higher risk tolerance may accept greater volatility in pursuit of potentially higher returns. Conversely, those with lower risk tolerance should focus on preserving capital and may benefit from more conservative strategies during periods of market uncertainty. Diversification across asset classes remains a cornerstone of effective risk management, as it helps reduce the impact of negative performance in any single asset.

The Psychology of Risk Tolerance in Investing

Understanding your risk tolerance is crucial for successful investing. It’s not just about numbers; it’s deeply intertwined with your psychology and emotional responses to potential losses and gains.

Risk aversion, the tendency to prefer certain outcomes over uncertain ones, even if the uncertain option offers a higher expected return, is common. Highly risk-averse investors may prioritize capital preservation above all else, opting for low-return, low-risk investments.

Conversely, risk-seeking individuals might be more comfortable with higher-risk investments in pursuit of potentially greater returns. Their emotional response to losses might be less intense, allowing them to weather market fluctuations more easily.

Your personal circumstances significantly influence your risk tolerance. Factors like age, financial goals (e.g., retirement, education), and time horizon play a vital role. Younger investors with longer time horizons can generally tolerate more risk than those nearing retirement.

It’s important to note that risk tolerance isn’t static. Life events and market experiences can shift your comfort level with risk. Regularly reassessing and adjusting your investment strategy based on your evolving circumstances and emotional responses is essential for long-term success.

Honest self-assessment is key. Understanding your psychological predisposition towards risk allows you to make informed investment decisions aligned with your personality and financial objectives. Consulting with a financial advisor can help you objectively determine your risk tolerance and build a suitable portfolio.

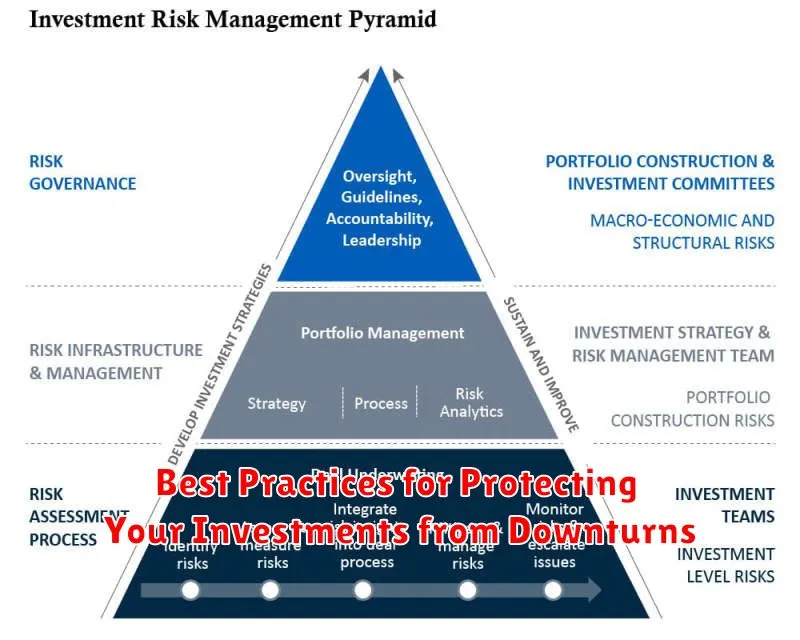

Best Practices for Protecting Your Investments from Downturns

Protecting your investments during market downturns requires a proactive and diversified approach. Diversification across different asset classes (stocks, bonds, real estate, etc.) is crucial to reduce the impact of any single market sector’s decline.

Regular rebalancing of your portfolio is key. This involves adjusting your asset allocation back to your target percentages after market fluctuations. Selling some assets that have performed well and buying those that have underperformed helps to lock in profits and capitalize on potential growth opportunities.

Building a sufficient emergency fund is paramount. This provides a cushion against unexpected expenses, preventing the need to sell investments at inopportune moments during market downturns.

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. This helps mitigate the risk of investing a lump sum at a market peak.

Consider incorporating protective investment strategies such as hedging or options. These advanced techniques require significant knowledge and should be undertaken with professional guidance.

Finally, maintaining a long-term perspective is essential. Market fluctuations are normal; focusing on your long-term financial goals and avoiding emotional decision-making will help you weather market storms successfully.