Inflation is a significant concern for investors, eroding the purchasing power of their assets and impacting investment returns. Understanding the multifaceted impact of inflation on investments is crucial for protecting your portfolio. This article will explore how inflation affects various asset classes, outlining effective strategies to hedge against inflation and preserve your financial wealth. We will delve into practical methods to navigate this economic challenge and maintain long-term investment growth, even in an inflationary environment.

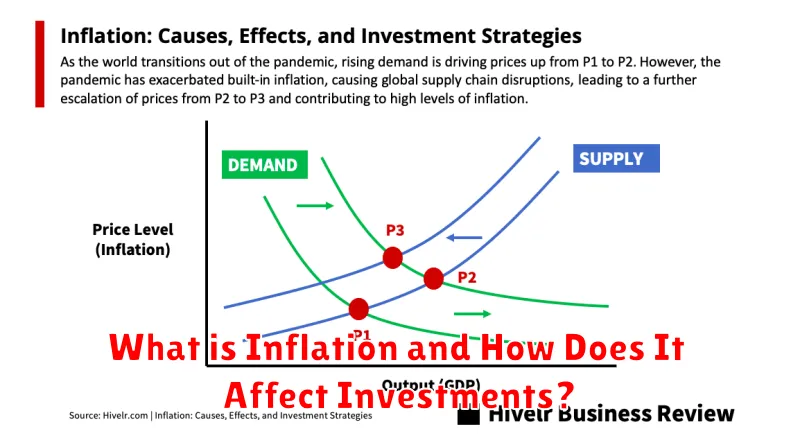

What is Inflation and How Does It Affect Investments?

Inflation is a general increase in the prices of goods and services in an economy over a period of time. When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy.

Inflation significantly impacts investments. Rising inflation erodes the real return on investments. For example, if your investment grows by 5%, but inflation is 3%, your real return is only 2%. This means your purchasing power has only increased by 2%, not 5%. Certain investments, like bonds, are particularly vulnerable to inflation as their fixed interest payments lose value when prices rise.

Conversely, some assets can act as a hedge against inflation. Real estate and commodities, for instance, often appreciate in value during inflationary periods, as their prices tend to rise with the overall price level. Equities (stocks) can also provide a degree of inflation protection, as companies can often pass increased costs onto consumers, maintaining profitability.

Understanding the relationship between inflation and investments is crucial for making informed financial decisions. Investors need to consider the potential impact of inflation on their portfolio’s returns and diversify their holdings accordingly to mitigate risk.

The Best Asset Classes to Hedge Against Inflation

Inflation erodes the purchasing power of money, impacting investment returns. To mitigate this risk, investors often turn to asset classes that historically perform well during inflationary periods. These typically offer protection through price appreciation or income streams that outpace inflation.

Real estate is often considered a strong hedge. Property values tend to rise with inflation, and rental income provides a steady cash flow. Commodities, such as gold and oil, also act as inflation hedges. Their prices usually increase alongside inflation, offering a store of value.

Treasury Inflation-Protected Securities (TIPS) are government bonds whose principal adjusts with inflation. This ensures investors receive a real return, protected from inflation’s impact. While considered less volatile than other options, TIPS offer a degree of inflation protection within a fixed income portfolio.

Equities, particularly in companies with pricing power, can also serve as a hedge. Companies that can pass rising costs onto consumers tend to maintain profitability during inflation. Selecting companies with strong competitive positions is crucial in this context.

Diversification across these asset classes is key. No single asset class guarantees complete protection from inflation. A well-diversified portfolio, tailored to individual risk tolerance and financial goals, is the most effective approach to managing inflation risk.

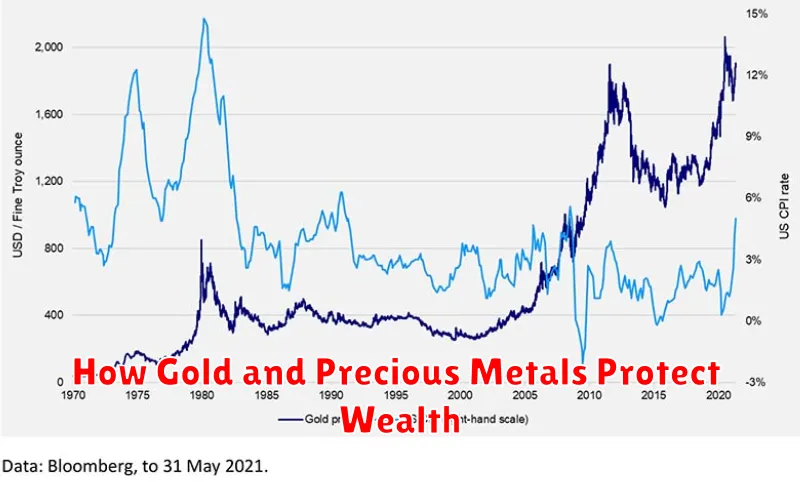

How Gold and Precious Metals Protect Wealth

Inflation erodes the purchasing power of fiat currencies. As prices rise, the value of cash decreases. Gold and other precious metals, however, have historically held their value during inflationary periods. Their inherent scarcity and enduring demand make them a reliable store of value.

Unlike fiat currencies, which are subject to government manipulation and economic fluctuations, the value of precious metals like gold, silver, platinum, and palladium is largely determined by global supply and demand. This inherent stability makes them an effective hedge against inflation.

Investing in gold and other precious metals offers a way to diversify your portfolio and mitigate the risks associated with inflation. They serve as a safe haven asset during times of economic uncertainty, providing a degree of protection for your wealth.

While precious metals are not immune to price fluctuations, their long-term performance tends to be positively correlated with periods of high inflation. Therefore, a well-diversified investment portfolio that includes a certain allocation to precious metals can offer significant protection against the detrimental effects of inflation.

The Role of Real Estate in Inflation-Proof Investing

Real estate can serve as a significant component of an inflation-proof investment strategy. Property values tend to rise with inflation, offering a natural hedge against the erosion of purchasing power. As the cost of goods and services increases, so too does the rental income generated from properties, further mitigating inflationary pressures.

The tangible nature of real estate is another key advantage. Unlike stocks or bonds, which are essentially intangible assets, real estate provides a physical asset that maintains its value, even during periods of high inflation. Furthermore, leverage can be employed to amplify returns, allowing investors to purchase properties with a relatively small initial investment.

However, it’s crucial to acknowledge that real estate investing is not without risks. Market fluctuations, property maintenance costs, and potential vacancies can all impact profitability. Careful due diligence, including thorough market research and professional advice, is essential for successful inflation-hedging through real estate.

Moreover, the liquidity of real estate investments is generally lower compared to other asset classes. Selling a property often takes time and involves transaction costs. Therefore, real estate should be considered a long-term investment within a diversified portfolio.

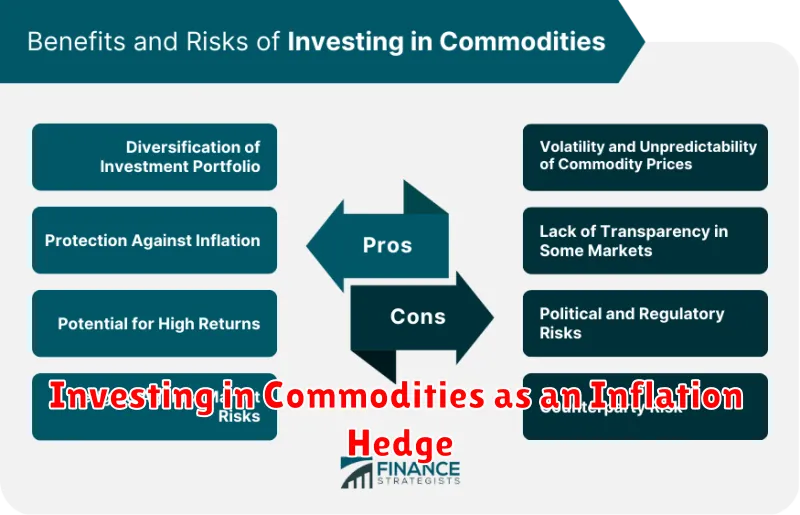

Investing in Commodities as an Inflation Hedge

Commodities, such as gold, oil, and agricultural products, can serve as an effective inflation hedge. Their prices tend to rise alongside inflation, preserving the real value of your investment.

Gold, in particular, is often viewed as a safe haven asset during inflationary periods. Its inherent value and limited supply make it a desirable store of value when fiat currencies are losing purchasing power.

Oil prices are directly influenced by inflation. Increased production costs, driven by inflation, typically translate to higher oil prices. Similarly, other industrial metals like copper benefit from increased demand during periods of economic expansion often fueled by inflationary pressures.

Agricultural commodities, such as wheat and corn, can also act as an inflation hedge. Rising input costs for farming, including fertilizer and labor, are directly passed on to consumers, resulting in higher food prices. Investing in these commodities through futures contracts or ETFs can provide protection against rising food inflation.

It’s important to note that while commodities can offer inflation protection, they are volatile assets. Their prices can fluctuate significantly, and investors should carefully consider their risk tolerance before investing.

How Inflation-Linked Bonds Work

Inflation-linked bonds, also known as inflation-indexed bonds or linkers, are debt securities whose principal value is adjusted based on the rate of inflation. This adjustment protects investors from the erosion of purchasing power caused by rising prices.

The principal of an inflation-linked bond increases in line with a specified inflation index, such as the Consumer Price Index (CPI). When the bond matures, the investor receives the adjusted principal plus any accumulated interest. The interest payments themselves may also be adjusted for inflation, depending on the specific bond structure.

This mechanism provides a hedge against inflation. While the return may not be significantly higher than inflation in a low-inflation environment, it ensures that the investor’s capital retains its real value during periods of high inflation, unlike traditional fixed-income securities.

Key features of inflation-linked bonds include a defined inflation index, a specified adjustment formula, and a maturity date. However, it’s important to note that the return on these bonds is not guaranteed to outpace inflation in all scenarios; the interest rate component is still subject to market forces.

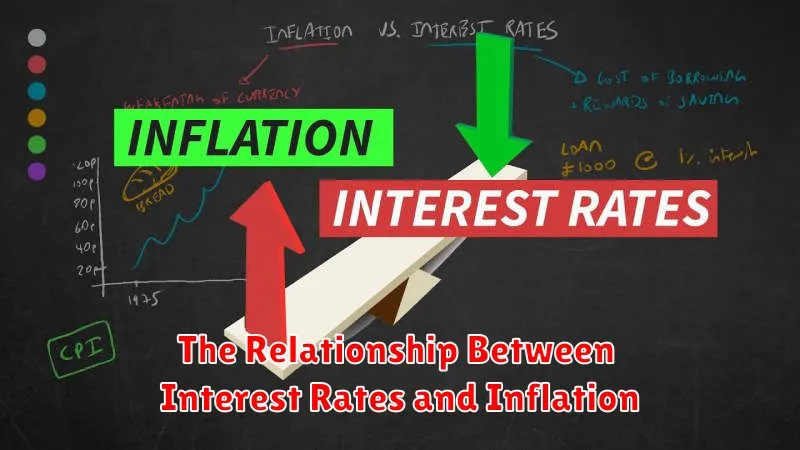

The Relationship Between Interest Rates and Inflation

Inflation and interest rates are intricately linked. Central banks often use interest rates as a tool to manage inflation. When inflation rises above the target rate, central banks typically raise interest rates. This makes borrowing more expensive, cooling down economic activity and reducing demand, which in turn helps curb inflation.

Conversely, when inflation is low or falling, central banks may lower interest rates to stimulate economic growth. Lower rates encourage borrowing and spending, boosting demand and potentially increasing inflation. This relationship, however, isn’t always straightforward and can be influenced by other economic factors.

The relationship is often described as an inverse correlation, meaning that as interest rates increase, inflation tends to decrease, and vice versa. However, this isn’t a guaranteed outcome; the effectiveness of interest rate adjustments depends on a multitude of complex economic conditions.

Understanding this dynamic is crucial for investors, as it significantly impacts investment returns and strategies. High inflation erodes the purchasing power of returns, while interest rate changes influence the cost of borrowing and the attractiveness of various investment options.

Strategies to Adjust Your Portfolio for Inflationary Periods

Inflation erodes the purchasing power of your investments. To protect your portfolio, consider these strategies:

Diversify into inflation-hedging assets: Include assets that historically perform well during inflationary periods. Real estate, commodities (like gold and oil), and inflation-protected securities (TIPS) are prime examples. These assets tend to retain or even increase their value when prices rise.

Shift towards value stocks: Value stocks, companies trading below their intrinsic value, often outperform during inflation. These businesses can usually pass increased costs onto consumers, protecting their profit margins.

Increase your allocation to tangible assets: Tangible assets, like real estate or precious metals, can act as a safeguard against inflation. Their inherent value tends to rise with inflation, offering a hedge against currency devaluation.

Rebalance your portfolio regularly: Regularly reviewing and adjusting your asset allocation ensures you maintain your desired risk profile and capitalize on market opportunities. This is particularly crucial during inflationary periods, as asset valuations can shift significantly.

Consider short-term investments: Short-term investments, such as high-yield savings accounts or money market funds, may offer a lower return, but they offer greater liquidity and protection against significant losses in a volatile market.

Adjust your investment timeframe: Inflation can affect your long-term financial goals. You might need to reassess your investment timeline and adjust your strategies accordingly to ensure you meet your objectives despite inflation.

Consult a financial advisor: A financial advisor can help you develop a personalized strategy that aligns with your risk tolerance and financial objectives, providing tailored guidance for navigating inflationary environments.