Choosing between hedge funds and mutual funds is a critical decision for any investor. This article will delve into the key differences between these two popular investment vehicles, exploring their respective investment strategies, risk profiles, and fee structures. Understanding these nuances is paramount to making an informed choice that aligns with your financial goals and risk tolerance.

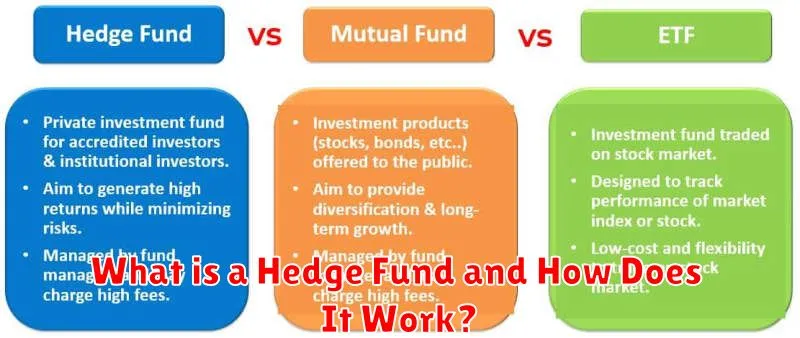

What is a Hedge Fund and How Does It Work?

A hedge fund is a relatively loosely regulated investment fund that employs sophisticated investment strategies to generate high returns for its investors. Unlike mutual funds, hedge funds typically have a limited number of high-net-worth investors and often require substantial minimum investments.

Hedge funds achieve their returns through a wide array of strategies, including long and short selling, leveraging (borrowing money to amplify returns), and investing in derivatives. These strategies aim to profit in both rising and falling markets, offering the potential for higher returns than traditional investments but also significantly higher risk.

The operational structure of a hedge fund is often complex. They are typically managed by professional investment managers who have significant experience and expertise in financial markets. The fees charged by hedge funds are generally higher than those of mutual funds, often involving a combination of management fees and performance-based fees (incentive fees).

Transparency is limited in the hedge fund industry, with fewer regulatory reporting requirements compared to mutual funds. This lack of transparency is a significant factor to consider when evaluating whether a hedge fund is a suitable investment.

Understanding Mutual Funds and Their Benefits

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, and other assets. This diversification is a key benefit, reducing the overall risk compared to investing in individual securities.

Professional management is another significant advantage. Experienced fund managers research and select investments, aiming to achieve specific investment objectives, relieving individual investors of this responsibility. This expertise can lead to potentially higher returns.

Accessibility is a major draw. Mutual funds are relatively easy to buy and sell, often requiring only a small initial investment. This makes them a convenient option for investors of all levels.

Liquidity is generally high, enabling investors to readily buy or sell their shares. However, the exact liquidity depends on the specific fund and market conditions.

Transparency is relatively high, with regular reporting on fund performance and holdings. This allows investors to monitor their investment and make informed decisions.

While offering many advantages, it’s important to note that mutual funds are subject to market risks and their performance is not guaranteed. Fees, including expense ratios and management fees, also need to be considered.

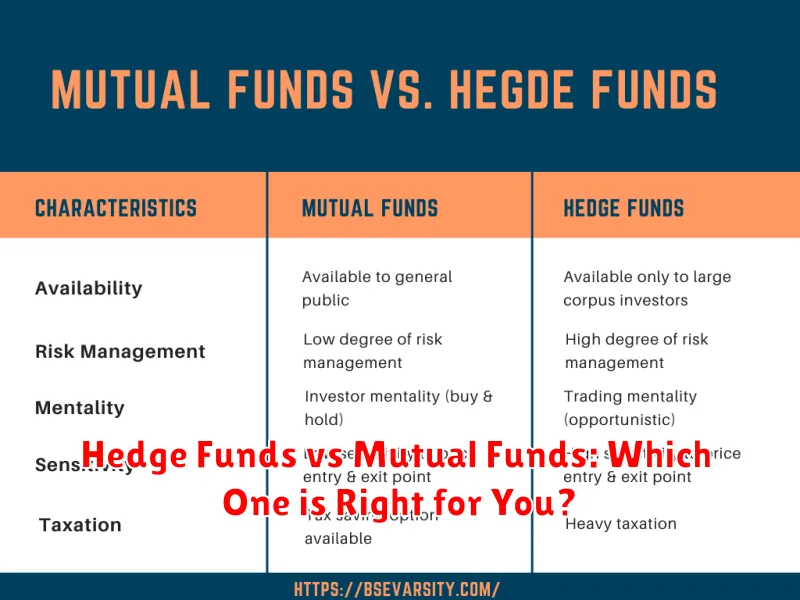

Hedge Funds vs Mutual Funds: Which One is Right for You?

The choice between hedge funds and mutual funds hinges on your investment goals, risk tolerance, and financial resources. Mutual funds are generally more accessible, requiring lower minimum investments and offering greater diversification across a broader range of asset classes. They are suitable for most investors seeking long-term growth with moderate risk.

Hedge funds, conversely, are typically only accessible to accredited investors due to high minimum investments and complex investment strategies. They often employ leveraged positions and pursue less conventional investment approaches, potentially leading to significantly higher returns but also substantially greater risk. Hedge funds are generally better suited for sophisticated investors with a high-risk tolerance and a long-term perspective who can weather potential periods of significant losses.

Ultimately, the “right” choice depends entirely on your individual circumstances. If you are a relatively less experienced investor with a lower risk tolerance and limited capital, a mutual fund is likely the more appropriate option. However, if you are a high-net-worth individual with significant investment experience, a higher risk tolerance, and a desire for potentially higher returns, a hedge fund might be considered, albeit with a thorough understanding of the inherent risks involved.

The Role of Fund Managers in Investment Strategies

Fund managers play a crucial role in shaping investment strategies for both hedge funds and mutual funds. Their expertise in analyzing markets, identifying investment opportunities, and managing risk directly impacts fund performance.

In hedge funds, managers often employ sophisticated and complex strategies, including leverage, short selling, and derivatives. Their active management style aims to generate high returns, even in volatile market conditions. They have significant autonomy and flexibility in their investment decisions.

Mutual fund managers, on the other hand, typically follow a more passive or moderately active investment approach, often tracking a specific index or sector. Their primary focus is on achieving consistent returns that align with the fund’s stated investment objective, while managing risk within pre-defined parameters. They operate under stricter regulatory guidelines and may face more limitations in their investment choices.

Regardless of fund type, successful fund managers possess a combination of strong analytical skills, market knowledge, risk management expertise, and an understanding of investor preferences. The manager’s investment philosophy and experience significantly influence the overall performance and direction of the fund.

How Hedge Funds Use Leverage and Alternative Assets

Unlike mutual funds, hedge funds frequently employ leverage to amplify returns. This involves borrowing money to increase investment size, potentially magnifying both profits and losses. The use of leverage is a significant differentiator, exposing hedge fund investors to considerably higher risk.

Furthermore, hedge funds heavily invest in alternative assets, which are not typically held by mutual funds. These include private equity, real estate, commodities, and distressed debt. Access to these alternative assets often requires specialized knowledge and networks, contributing to hedge funds’ higher management fees and potentially greater returns (but also higher risk).

The combination of leverage and alternative asset investments allows hedge funds to pursue a wider range of investment strategies, such as short selling, arbitrage, and event-driven investing. These strategies are generally unavailable to mutual funds due to regulatory constraints and the nature of their investor base.

It’s crucial to understand that the use of leverage and alternative assets introduces significant risk. While potentially leading to higher returns, these strategies can also result in substantial losses if market conditions turn unfavorable. This higher risk tolerance is a defining characteristic that separates hedge funds from mutual funds.

How Mutual Funds Provide Diversification for Investors

Mutual funds offer investors a powerful tool for diversification. Instead of investing in a single stock or bond, a mutual fund pools money from multiple investors to purchase a portfolio of various assets.

This diversification across different asset classes (e.g., stocks, bonds, real estate) and sectors minimizes risk. If one investment underperforms, the losses are offset by the potentially strong performance of others within the fund.

The level of diversification varies depending on the fund’s investment objective. Some funds focus on specific sectors or asset classes, while others aim for broad market exposure.

This built-in diversification is particularly beneficial for investors with limited capital or investment expertise, as it allows them to access a wide range of investments without the need for extensive research and individual stock picking.

By spreading risk across many investments, mutual funds provide a relatively stable and potentially less volatile investment compared to investing in individual securities. This makes them a suitable option for risk-averse investors seeking long-term growth.

Performance Comparison: Hedge Funds vs Mutual Funds

Directly comparing the performance of hedge funds and mutual funds is challenging due to significant differences in investment strategies, reporting requirements, and accessibility. Hedge funds, often employing complex and high-risk strategies, typically aim for absolute returns, irrespective of market conditions. Their performance data is less transparent and often only available to investors after a considerable delay.

Mutual funds, on the other hand, are generally more transparent and regulated, with performance readily available. They typically benchmark their returns against relevant market indexes. While some mutual funds might pursue specific strategies (e.g., growth or value), their overall approach tends to be less aggressive and riskier than most hedge funds.

Historically, hedge funds have shown the potential for higher returns but also carry substantially higher risk, including significant losses. The volatility of hedge fund performance is typically much greater than mutual funds. Mutual funds, while offering lower potential returns, generally provide more consistent and predictable results, although past performance is never a guarantee of future returns for either investment type.

It’s crucial to remember that comparing performance requires careful consideration of factors such as fees, risk profiles, and investment horizons. The “best” choice hinges entirely on an investor’s individual circumstances, risk tolerance, and investment goals.

Risks and Regulations of Investing in Hedge Funds

Investing in hedge funds carries significant risks due to their complex investment strategies and often leveraged positions. These strategies can include short selling, derivatives trading, and arbitrage, which amplify both potential gains and losses.

Liquidity risk is another major concern. Hedge funds often have lock-up periods, restricting access to invested capital for a specified duration. This can create difficulties for investors needing immediate access to their funds.

Operational risk is also present, stemming from the potential for mismanagement, fraud, or other internal failures within the fund’s operations. The lack of stringent regulatory oversight compared to mutual funds further exacerbates this risk.

Regulatory oversight of hedge funds is generally less stringent than that of mutual funds. While some regulations exist, particularly concerning investor disclosures and anti-fraud measures, the less stringent regulatory environment introduces further uncertainty and potential for risk.

Performance volatility is characteristic of hedge funds. Their strategies often aim for high returns, but this pursuit inherently involves heightened risk and fluctuations in performance. Past performance is not indicative of future results.

Transparency is often limited, making it difficult for investors to fully understand the fund’s investment strategies and holdings. This lack of transparency makes assessing risk and evaluating performance challenging.

Prospective investors should carefully assess their risk tolerance and thoroughly research any hedge fund before investing. Professional advice from a qualified financial advisor is strongly recommended.