Are you interested in learning how to trade forex? This comprehensive guide, “Forex Trading for Beginners: How to Trade Currencies Successfully,” provides a step-by-step introduction to the exciting world of currency trading. Discover the fundamentals of forex trading, learn essential strategies for successful trading, and understand the risks involved. Whether you’re a complete novice or have some prior experience, this guide will equip you with the knowledge and skills necessary to navigate the forex market confidently and potentially achieve your financial goals. Unlock the secrets to becoming a successful forex trader today!

What is Forex Trading and How Does It Work?

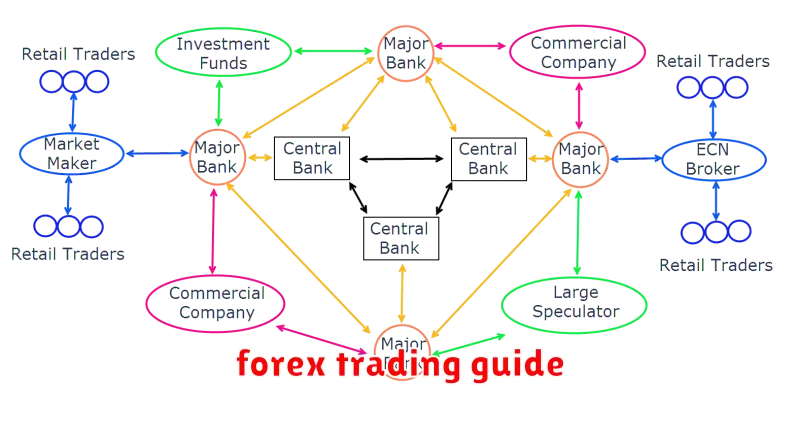

Forex trading, or foreign exchange trading, is the global marketplace for exchanging national currencies. It’s the largest and most liquid market in the world, operating 24 hours a day, five days a week.

It works by speculating on currency price movements. Traders buy one currency (the base currency) and simultaneously sell another (the quote currency), profiting from the difference in value between the two currencies. For example, buying EUR/USD means buying Euros and selling US Dollars. If the Euro strengthens against the Dollar, the trader profits.

Trades are executed using forex brokers who provide access to the market. Traders use various technical and fundamental analysis tools to predict price movements and manage risk. Profits are realized when the trader sells the currency pair at a higher price than they bought it.

Leverage is often used in forex trading, allowing traders to control larger positions with a smaller amount of capital. While leverage amplifies potential profits, it also significantly increases risk. Understanding leverage is crucial for successful forex trading.

Major Currency Pairs and How to Trade Them

The foreign exchange (forex or FX) market trades currencies in pairs. Understanding these pairs is crucial for successful trading.

Major currency pairs involve the US dollar (USD) against another major currency. These are the most liquid and volatile, offering frequent trading opportunities. Examples include:

- EUR/USD (Euro/US Dollar): The most traded pair, reflecting the economic relationship between the Eurozone and the US.

- USD/JPY (US Dollar/Japanese Yen): Influenced by interest rate differentials and economic data from both countries.

- GBP/USD (British Pound/US Dollar): Often volatile due to the UK’s independent monetary policy and global economic influence.

- USD/CHF (US Dollar/Swiss Franc): Known for its relative stability, often used as a safe haven.

- USD/CAD (US Dollar/Canadian Dollar): Highly correlated with commodity prices, especially oil.

Trading these pairs involves speculating on the future exchange rate. If you believe the Euro will strengthen against the US dollar, you buy EUR/USD. Conversely, if you think the dollar will strengthen, you sell EUR/USD (or buy USD/EUR).

Success depends on fundamental and technical analysis. Fundamental analysis considers economic indicators and geopolitical events. Technical analysis focuses on price charts and patterns to predict future price movements. Risk management is paramount; using stop-loss orders to limit potential losses is crucial.

Beginners should start with a demo account to practice trading without risking real capital. Thorough research and understanding of market dynamics are vital before engaging in live trading.

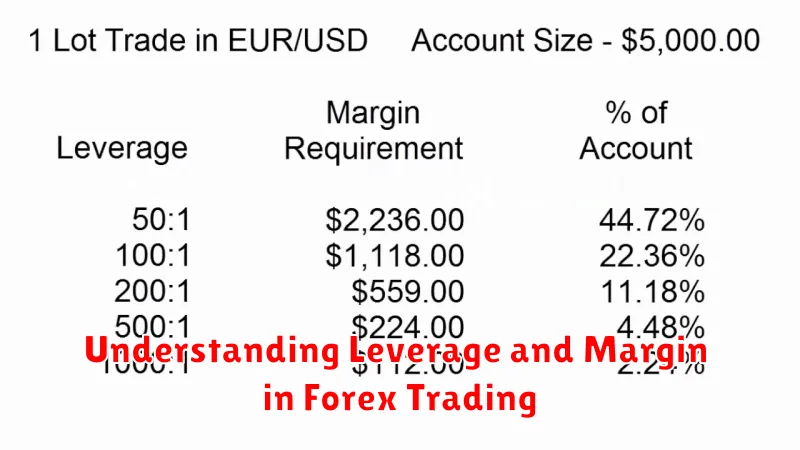

Understanding Leverage and Margin in Forex Trading

Leverage in forex trading allows you to control a larger position in the market than your initial investment would normally allow. For example, a 1:100 leverage means you can control $100,000 worth of currency with only $1,000 of your own capital. This magnifies both profits and losses.

Margin is the amount of money you deposit in your trading account to open and maintain a leveraged position. It acts as collateral. The required margin is a percentage of the total trade value, determined by your broker and leverage. Maintaining sufficient margin is crucial; if your losses deplete your margin below a certain level (margin call), your broker may automatically close your positions to prevent further losses.

Understanding leverage and margin is fundamental. While leverage amplifies potential gains, it equally amplifies potential losses. Careful risk management, including using appropriate leverage levels and setting stop-loss orders, is vital to prevent significant losses. Beginners should start with lower leverage to gain experience before increasing exposure.

The Role of Central Banks in Currency Markets

Central banks play a crucial role in influencing currency markets. Their primary function is to maintain price stability and manage their nation’s monetary policy. This involves setting interest rates, which directly impact a currency’s value.

Higher interest rates generally attract foreign investment, increasing demand for the currency and strengthening its value. Conversely, lower interest rates can weaken a currency as investors seek higher returns elsewhere. Central banks also intervene directly in the forex market by buying or selling their own currency to influence its exchange rate, often to manage volatility or prevent sharp fluctuations. These actions, however, are typically strategic and infrequent, designed to influence long-term trends rather than day-to-day movements.

Understanding a central bank’s actions and their likely impact on a currency is essential for forex traders. Announcements regarding interest rate decisions, inflation targets, and other monetary policy statements can cause significant and rapid market reactions. Traders carefully analyze these announcements and their implications to inform their trading strategies. Therefore, staying informed about central bank activities is crucial for successful forex trading.

Technical Analysis vs Fundamental Analysis in Forex

Forex trading relies heavily on two primary analysis methods: technical analysis and fundamental analysis. Understanding their differences is crucial for successful trading.

Technical analysis focuses on price charts and trading volume to identify patterns and predict future price movements. Traders use various indicators and tools, such as moving averages, RSI, and chart patterns, to spot potential entry and exit points. It’s a short-term to medium-term strategy, largely ignoring underlying economic factors.

Fundamental analysis, conversely, examines the economic and political factors that influence currency values. This includes analyzing interest rates, inflation, GDP growth, and political stability. Fundamental analysts aim to identify undervalued or overvalued currencies based on these macroeconomic factors. This is typically a longer-term strategy.

While both methods offer valuable insights, many successful forex traders use a combination of both. Technical analysis can pinpoint optimal entry and exit points within a trend identified through fundamental analysis. Choosing the right approach depends on individual trading styles, risk tolerance, and time horizons.

How to Manage Risks in Forex Trading

Forex trading, while potentially lucrative, involves significant risk. Effective risk management is crucial for long-term success. Beginners should prioritize learning these strategies before investing substantial capital.

Only trade with money you can afford to lose. This is the most fundamental rule. Never invest borrowed money or funds essential for living expenses.

Use stop-loss orders. These orders automatically close a trade when the price reaches a predetermined level, limiting potential losses. Setting appropriate stop-loss levels is crucial and requires understanding market volatility.

Diversify your portfolio. Don’t put all your eggs in one basket. Spread your investments across different currency pairs to reduce the impact of losses on a single trade.

Employ position sizing. This strategy determines the amount of capital allocated to each trade. Smaller positions reduce the impact of losses, while larger positions potentially yield greater profits (but also greater losses).

Keep a trading journal. Record your trades, including entry and exit points, profits/losses, and rationale. Analyzing this data helps identify patterns, strengths, and weaknesses in your trading strategy, leading to improved risk management over time.

Practice with a demo account. Before trading with real money, use a demo account to test strategies and refine your risk management approach in a risk-free environment. This allows for learning without financial consequences.

Continuously learn and adapt. The forex market is dynamic. Staying updated on market trends, news, and economic indicators is essential for informed decision-making and effective risk mitigation.

Avoid emotional trading. Fear and greed can lead to impulsive decisions that negatively impact trading performance. Maintain discipline and stick to your predetermined risk management plan.

Best Forex Trading Strategies for Beginners

Forex trading can seem daunting, but several strategies are particularly well-suited for beginners. Focusing on a few key strategies instead of trying to master many is crucial for early success.

Trend Following is a popular strategy. This involves identifying the overall direction (uptrend or downtrend) of a currency pair and trading in that direction. Simple moving averages can help identify trends.

Range Trading works well in sideways markets. This strategy involves buying near support levels and selling near resistance levels within a defined range. Support and resistance lines can be identified using chart patterns.

Scalping involves taking many small profits over short periods. This strategy requires quick decision-making and a deep understanding of market volatility. It’s generally not recommended for beginners due to its high-risk nature.

News Trading involves leveraging significant economic events and announcements to predict market movements. This requires diligent fundamental analysis and understanding of economic indicators. Beginners should approach this cautiously, focusing on major events with clear market impact.

Remember, consistent risk management is paramount. Beginners should always use small position sizes and never risk more than they can afford to lose. Backtesting your chosen strategy on historical data is also vital before implementing it with real money.

Common Mistakes to Avoid in Forex Trading

Forex trading, while potentially lucrative, is fraught with pitfalls for beginners. One of the most common mistakes is overtrading. Entering too many trades simultaneously can lead to emotional decision-making and significant losses. Beginners should focus on mastering a consistent trading strategy before increasing trade frequency.

Another frequent error is neglecting risk management. Failing to use stop-loss orders and position sizing appropriate to your account balance can quickly wipe out your capital. Proper risk management is crucial for long-term success.

Many new traders fall victim to emotional trading. Fear and greed can cloud judgment, leading to impulsive decisions that often result in losses. Developing a disciplined approach and sticking to your trading plan, even during market volatility, is essential.

Ignoring fundamental and technical analysis is another prevalent mistake. Successful forex trading requires a comprehensive understanding of both market fundamentals (economic data, political events) and technical indicators (charts, patterns). Thorough analysis is key to making informed trading decisions.

Finally, lack of education and preparation is a major hurdle for beginners. Forex trading is complex and requires dedicated learning. Taking the time to educate yourself on trading strategies, risk management techniques, and market dynamics significantly increases your chances of success.