This article explores the crucial role of Exchange-Traded Funds (ETFs) in constructing a well-diversified investment portfolio. We will examine how ETFs offer investors a cost-effective and efficient way to gain broad market exposure, access diverse asset classes, and implement sophisticated investment strategies, ultimately contributing to improved portfolio performance and reduced risk. Learn how strategically incorporating ETFs can significantly enhance your investment strategy and help you achieve your financial goals.

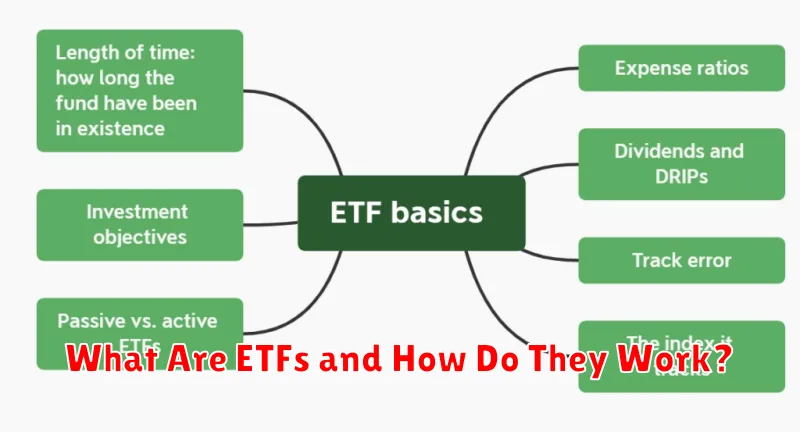

What Are ETFs and How Do They Work?

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, much like individual stocks. Unlike mutual funds, ETFs can be bought and sold throughout the trading day.

ETFs typically track a specific index, such as the S&P 500, a sector (e.g., technology), or a commodity (e.g., gold). They offer diversified exposure to a basket of underlying assets, providing investors with a convenient way to gain broad market participation.

How they work: An ETF’s price fluctuates throughout the trading day based on supply and demand, mirroring the performance of its underlying assets. When you buy an ETF, you are purchasing a share representing a proportionate ownership in the underlying assets the ETF holds. When you sell, you are selling that share.

Key features: ETFs generally have low expense ratios compared to actively managed mutual funds, making them an attractive option for long-term investors. They offer transparency, as their holdings are publicly disclosed.

Differences Between ETFs and Mutual Funds

Exchange-Traded Funds (ETFs) and mutual funds are both investment vehicles that pool money from multiple investors to invest in a diversified portfolio of assets. However, they differ significantly in several key aspects.

Trading: ETFs trade like stocks on exchanges throughout the trading day, allowing for intraday buying and selling. Mutual funds, on the other hand, are priced only once at the end of the trading day, meaning you buy or sell at the Net Asset Value (NAV) calculated at that time.

Expense Ratios: Generally, ETFs tend to have lower expense ratios than mutual funds, resulting in greater returns for investors over time. This is because ETFs typically have a more passive management approach.

Minimum Investment: ETFs usually require the purchase of a single share, making them accessible to investors with smaller capital. Mutual funds often have higher minimum investment requirements.

Management Style: While both can employ active or passive management strategies, ETFs are more commonly associated with passive management, tracking a specific index, whereas mutual funds can employ either approach.

Tax Efficiency: ETFs are often more tax-efficient than mutual funds. They generally generate fewer taxable events due to their less frequent trading activity and in-kind creations and redemptions.

In summary, the choice between ETFs and mutual funds depends on individual investor needs and preferences, considering factors like trading frequency, expense ratios, minimum investment, and desired management style.

How to Choose the Right ETFs for Your Portfolio

Selecting the appropriate ETFs for your portfolio requires careful consideration of several key factors. Diversification is paramount; avoid over-concentrating in a single sector or asset class. Consider your investment goals and risk tolerance. Are you aiming for long-term growth, income generation, or a balance of both? Your risk tolerance will determine the allocation to stocks versus bonds and the level of volatility you’re comfortable with.

Expense ratios are crucial. Lower expense ratios translate to greater returns over time. Compare the expense ratios of similar ETFs before making a decision. Past performance is not indicative of future results, but it provides insights into an ETF’s historical volatility and returns. Examine the ETF’s historical performance data in relation to its benchmark index.

Analyze the ETF’s holdings. Understand the underlying assets within the ETF to ensure alignment with your investment strategy. Consider the size and liquidity of the ETF. Larger, more liquid ETFs generally offer better price transparency and ease of trading.

Finally, rebalance your portfolio periodically to maintain your desired asset allocation. Market fluctuations will cause the weights of your holdings to shift, necessitating rebalancing to restore your target proportions. Regular reviews and adjustments are vital for successful long-term investing.

The Benefits of Passive Investing Through ETFs

Exchange-Traded Funds (ETFs) offer several key advantages for passive investors seeking diversified portfolios. Low costs are a primary benefit, with expense ratios significantly lower than actively managed funds. This translates to greater returns over time.

Diversification is another major advantage. ETFs often track broad market indices, instantly providing exposure to a wide range of securities. This reduces the risk associated with investing in individual stocks or bonds.

Simplicity and convenience are inherent in ETF investing. They trade like stocks on major exchanges, making buying and selling straightforward. Furthermore, the passive nature requires minimal ongoing management, saving investors both time and effort.

Tax efficiency is often enhanced through ETFs, particularly those structured as index funds. Lower portfolio turnover generally results in fewer capital gains distributions, leading to potential tax savings.

Finally, transparency is a crucial feature. The holdings of an ETF are publicly disclosed, allowing investors to understand the underlying assets and assess their risk profile before investing.

Understanding ETF Expense Ratios and Fees

Exchange-Traded Funds (ETFs) offer a cost-effective way to diversify your investment portfolio, but understanding their fees is crucial. Expense ratios are the annual fees charged by the fund to cover administrative and management costs. These are expressed as a percentage of your investment’s value and are deducted daily.

Expense ratios vary significantly depending on the ETF’s investment strategy and the fund manager. Lower expense ratios generally translate to greater returns over time. While seemingly small, these fees can compound significantly over the long term, impacting your overall investment growth.

Besides expense ratios, be aware of potential transaction fees. These are charged by your brokerage when you buy or sell ETFs. These fees are separate from the expense ratio and can vary depending on your brokerage account and the trading platform used. Always compare brokerage fees before investing.

Other fees to consider may include redemption fees or creation/redemption fees, though these are less common for individual investors. It’s important to carefully review the ETF’s prospectus to understand all associated costs.

To make informed decisions, carefully compare the total cost of ownership of different ETFs, considering both the expense ratio and brokerage fees. Choosing ETFs with lower overall costs can significantly enhance your investment returns.

The Role of Thematic ETFs in Investment Growth

Thematic ETFs offer a powerful tool for investors seeking targeted growth within a diversified portfolio. By focusing on specific sectors or trends like renewable energy, artificial intelligence, or e-commerce, they allow investors to capitalize on burgeoning industries.

Unlike broad market ETFs, thematic ETFs offer focused exposure to potentially high-growth areas. This concentrated approach can lead to significant returns if the chosen theme performs well. However, it’s crucial to understand that this targeted approach also carries higher risk compared to more diversified investments. A single poorly performing theme can significantly impact returns.

Careful due diligence is paramount when selecting thematic ETFs. Investors must thoroughly research the underlying holdings, the ETF’s management fees, and the potential risks associated with the specific theme. Diversification across multiple thematic ETFs, as well as inclusion of broader market ETFs, can help mitigate the risk associated with this strategy.

Successful thematic ETF investing requires a long-term perspective and a tolerance for volatility. While the potential for significant returns exists, investors should be prepared for periods of underperformance, particularly if the chosen theme experiences headwinds.

How to Hedge Risks Using ETFs

Exchange-Traded Funds (ETFs) offer a versatile tool for hedging various risks within a diversified portfolio. Inverse ETFs, for instance, profit when a specific index or asset class declines, providing a hedge against market downturns. Investing in an inverse ETF tied to a sector you’re concerned about can mitigate potential losses in that area.

Hedged ETFs are designed to reduce volatility by incorporating hedging strategies into their investment approach. These ETFs might employ techniques like options or futures contracts to limit downside risk. Choosing a hedged ETF aligned with your risk tolerance can help protect your portfolio from major market fluctuations.

Short-term Treasury bond ETFs are often used as a hedge against inflation and market uncertainty. These ETFs provide relative stability and liquidity, offering a safe haven during periods of market stress. They are considered a conservative hedge.

Commodity ETFs can serve as a hedge against inflation and provide diversification away from traditional equity markets. Investing in gold or other precious metal ETFs can be a strategy to protect your portfolio during inflationary periods or geopolitical instability. The price of these commodities often moves inversely to the market.

It’s crucial to carefully research specific ETFs before incorporating them into your hedging strategy. Understand the underlying assets, fees, and potential risks associated with each ETF to ensure it aligns with your overall investment objectives.

Long-Term Wealth Building with ETFs

Exchange-Traded Funds (ETFs) offer a powerful tool for long-term wealth building due to their inherent advantages. Their diversification across multiple assets minimizes risk compared to investing in individual stocks.

Low expense ratios are a key benefit. These lower costs directly translate to higher returns over the long term, compounding your investment’s growth.

Tax efficiency is another strong point. ETFs often generate fewer capital gains distributions compared to actively managed mutual funds, resulting in greater tax savings.

Accessibility and liquidity make ETFs easy to buy and sell, providing flexibility for investors. This ease of trading allows for convenient adjustments to your portfolio as your financial goals evolve.

By strategically selecting ETFs that align with your risk tolerance and long-term investment goals, you can create a diversified portfolio capable of achieving significant wealth growth over time. A buy-and-hold strategy with regular contributions often yields the best results.

Remember, while ETFs offer many benefits, thorough research and understanding your own financial situation are crucial before investing. Consider consulting with a qualified financial advisor for personalized guidance.