Investing in cryptocurrency can be both exciting and lucrative, but it also carries significant risk. This comprehensive guide, “Cryptocurrency Trading: How to Invest Wisely in Digital Assets,” will equip you with the knowledge and strategies necessary to navigate the volatile world of digital assets. We will explore various cryptocurrency investment approaches, including trading, holding (HODLing), and staking, while emphasizing the importance of risk management, diversification, and thorough market research. Learn how to identify promising cryptocurrencies, understand blockchain technology, and protect yourself from scams to make informed and potentially profitable investments in the ever-evolving crypto market.

The Basics of Cryptocurrency and Blockchain Technology

Before diving into cryptocurrency trading, understanding the underlying technology is crucial. Cryptocurrencies are digital or virtual currencies designed to work as a medium of exchange. They use cryptography to secure and verify transactions as well as to control the creation of new units of a particular cryptocurrency.

The core technology behind cryptocurrencies is blockchain. A blockchain is a distributed, immutable ledger that records and verifies transactions across a network of computers. This decentralized nature enhances security and transparency, reducing the risk of fraud and single points of failure. Each transaction is grouped into a “block” which is then added to the chain, creating a permanent and auditable record.

Decentralization is a key feature distinguishing cryptocurrencies from traditional fiat currencies. Unlike fiat currencies controlled by central banks, cryptocurrencies operate on a peer-to-peer network, making them resistant to government control and censorship. However, this decentralization also presents challenges regarding regulation and security.

Understanding the basics of cryptographic hashing is also important. This process ensures data integrity and security within the blockchain. Changes to any part of the blockchain would be immediately detectable due to changes in the hash, maintaining the immutability of the system.

Finally, it’s important to grasp the concept of mining in certain cryptocurrencies. Mining involves using computing power to solve complex mathematical problems, verifying transactions, and adding new blocks to the blockchain. Miners are rewarded with newly created cryptocurrency for their efforts.

How to Choose the Best Crypto Exchange for Trading

Choosing the right cryptocurrency exchange is crucial for successful trading. Security should be your top priority. Look for exchanges with robust security measures like two-factor authentication (2FA), cold storage for assets, and a proven track record of protecting user funds. Consider reading reviews and checking for any history of security breaches.

Fees are another important factor. Compare trading fees, withdrawal fees, and deposit fees across different platforms. Some exchanges offer tiered fee structures based on trading volume, potentially offering significant savings for high-volume traders.

Available cryptocurrencies vary widely between exchanges. Ensure the exchange lists the specific digital assets you intend to trade. Consider the diversity of assets offered, as well as any plans for future listings.

User experience is also critical. A user-friendly interface simplifies trading and research. Consider factors such as the platform’s ease of navigation, mobile app availability, and the quality of charting tools and order management features.

Regulation and compliance are increasingly important. Choose a reputable exchange that is registered and operates within a regulated jurisdiction. This adds a layer of protection for your investments and aligns with best practices.

Finally, consider the exchange’s customer support. Quick and effective customer support can be invaluable in resolving any issues that may arise. Look for exchanges with multiple support channels, such as email, phone, and live chat, along with a readily accessible FAQ section.

The Role of Bitcoin and Altcoins in the Market

Bitcoin, the first and most well-known cryptocurrency, plays a dominant role in the market, often setting the tone for overall price movements. Its market capitalization is significantly larger than any other cryptocurrency, making it a key indicator of market sentiment.

Altcoins, or alternative cryptocurrencies, represent a diverse range of projects with varying functionalities and goals. They often exhibit higher volatility than Bitcoin, presenting both greater risk and potential reward. Some altcoins aim to improve upon Bitcoin’s limitations, while others focus on specific use cases, such as decentralized finance (DeFi) or non-fungible tokens (NFTs).

The relationship between Bitcoin and altcoins is complex. Often, altcoin prices are correlated with Bitcoin’s price, meaning that when Bitcoin’s price rises, altcoin prices tend to follow suit, and vice-versa. However, individual altcoins can also experience significant price fluctuations independent of Bitcoin’s performance, depending on factors specific to their projects and the overall market conditions.

Understanding the interplay between Bitcoin and altcoins is crucial for informed investment decisions in the cryptocurrency market. Investors should consider their risk tolerance, research individual projects thoroughly, and diversify their portfolios appropriately to manage risk effectively.

How to Analyze Crypto Price Trends

Analyzing cryptocurrency price trends requires a multifaceted approach. Begin by examining historical price data using charts that illustrate price movements over various timeframes (daily, weekly, monthly). Look for patterns like support and resistance levels, trendlines, and candlestick formations to identify potential entry and exit points.

Technical indicators, such as moving averages (MA), relative strength index (RSI), and MACD, can provide further insights into momentum and potential reversals. Understanding these indicators and their interplay is crucial for informed decision-making. Remember that no single indicator provides a perfect prediction.

Beyond technical analysis, consider fundamental analysis. This involves researching the underlying technology, adoption rate, team behind the cryptocurrency, and overall market sentiment. News events, regulatory changes, and technological advancements significantly impact crypto prices. Stay informed through reputable sources.

Volume analysis is equally important. High trading volume accompanying price movements confirms the strength of a trend. Low volume suggests weak momentum and potential for price reversals. Always correlate price movements with volume to validate your analysis.

Finally, risk management is paramount. Diversify your portfolio, never invest more than you can afford to lose, and utilize stop-loss orders to limit potential losses. Consistent monitoring and adaptation of your strategy based on market conditions are key to successful crypto trading.

Understanding Crypto Wallets and Security Measures

Crypto wallets are digital storage units for your cryptocurrencies. They are crucial for securely managing your digital assets. Understanding their different types and security features is essential for safe cryptocurrency trading.

There are two main types: hardware wallets and software wallets. Hardware wallets, physical devices resembling USB drives, offer superior security by storing your private keys offline. Software wallets, which can be desktop, mobile, or web-based applications, are more convenient but generally less secure.

Security measures are paramount. Choose a reputable wallet provider with a strong track record. Enable two-factor authentication (2FA) whenever possible. Regularly update your wallet software to patch security vulnerabilities. Never share your private keys with anyone and be wary of phishing scams attempting to steal your credentials.

Strong passwords are also critical. Use a unique, complex password for each wallet and consider using a password manager to securely store them. Regularly back up your wallet but store your backups securely and offline.

By understanding the different types of crypto wallets and implementing robust security measures, you significantly reduce the risk of losing your digital assets. Prioritizing security is a fundamental aspect of wise cryptocurrency investing.

Trading Strategies: Day Trading vs HODLing

Day trading involves buying and selling cryptocurrencies within a single day, aiming to profit from short-term price fluctuations. It requires significant time commitment, technical analysis skills, and risk tolerance due to its inherent volatility. Success hinges on accurately predicting these short-term movements.

HODLing, on the other hand, is a long-term investment strategy. Investors who “HODL” (hold on for dear life) believe in the underlying value of a cryptocurrency and are willing to hold their assets for extended periods, often years, regardless of short-term market fluctuations. This strategy is generally considered less risky than day trading in the long run but requires patience and confidence in the chosen asset.

The optimal strategy depends heavily on individual risk tolerance, financial goals, and market knowledge. Day trading offers the potential for higher returns but entails substantially greater risk, while HODLing prioritizes long-term growth and reduces the impact of daily market volatility. Careful consideration of these factors is crucial before choosing a trading approach.

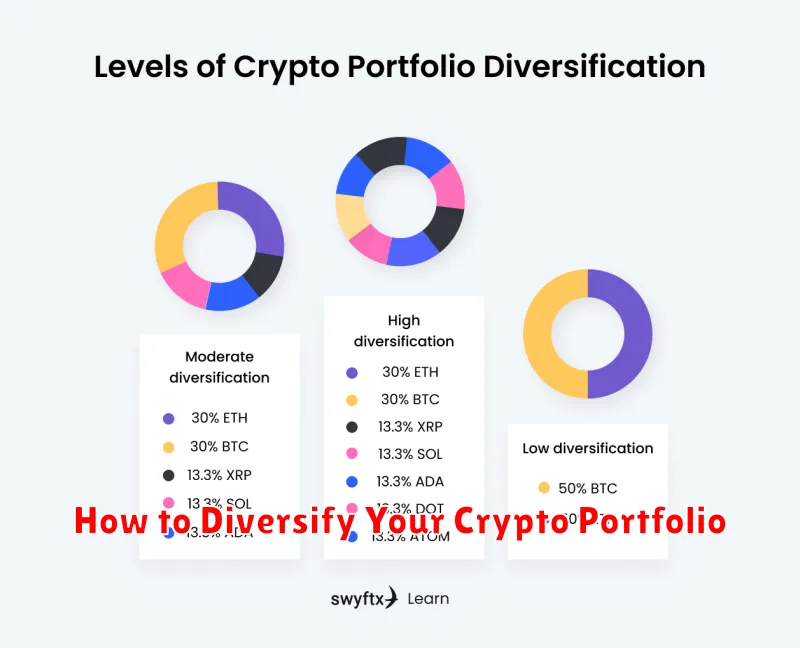

How to Diversify Your Crypto Portfolio

Diversification is crucial in mitigating risk within the volatile cryptocurrency market. A well-diversified portfolio reduces the impact of any single asset’s price fluctuation.

Consider diversifying across different cryptocurrency categories. This includes investing in a mix of Bitcoin (a store of value), Ethereum (a platform for decentralized applications), and altcoins (alternative cryptocurrencies with varying functionalities).

Another key aspect is market capitalization. Allocate investments across different market cap ranges; large-cap cryptocurrencies tend to be more stable, while smaller-cap cryptocurrencies offer higher potential returns (but also higher risk).

Risk tolerance is a significant factor. Conservative investors should allocate a larger portion to established, large-cap cryptocurrencies. More aggressive investors might allocate more to smaller-cap, higher-risk assets.

Regularly rebalance your portfolio. As the market changes, the proportions of your assets may shift. Rebalancing ensures you maintain your desired allocation and risk profile.

Finally, do your research. Understand the technology, use cases, and teams behind each cryptocurrency before investing. Diversification is not a guarantee against losses, but it’s a vital strategy for managing risk in the cryptocurrency market.

Regulations and Risks in Cryptocurrency Investing

The cryptocurrency market is largely unregulated, varying significantly across jurisdictions. This lack of oversight presents considerable risks for investors. While some countries are developing regulatory frameworks, many others have yet to establish clear rules governing cryptocurrency trading, exchanges, and Initial Coin Offerings (ICOs).

Market volatility is a primary concern. Cryptocurrency prices are notoriously susceptible to rapid and dramatic fluctuations, often driven by speculation, news events, and technological developments. These swings can lead to substantial gains or significant losses in a short period.

Security risks are also prevalent. Exchanges and individual wallets can be targets for hacking and theft, resulting in the loss of digital assets. The decentralized nature of cryptocurrencies, while offering certain advantages, also means that recovering stolen funds can be extremely difficult.

Scams and fraud are rampant in the cryptocurrency space. Investors need to be vigilant about fraudulent projects, pump-and-dump schemes, and other deceptive practices that aim to exploit newcomers. Thorough due diligence is crucial before investing in any cryptocurrency.

Tax implications can be complex and vary significantly depending on location. Investors should understand the tax laws in their jurisdictions concerning cryptocurrency transactions, gains, and losses to avoid potential legal issues.

Legal ambiguity further compounds the risks. The legal status of cryptocurrencies is still evolving globally. This uncertainty can affect the enforceability of contracts and the protection of investor rights.

Understanding these regulatory and risk factors is paramount for navigating the cryptocurrency market responsibly. Investors should exercise caution, conduct thorough research, and consider their risk tolerance before committing funds.