Are you looking to generate passive income? This article explores two popular methods within the cryptocurrency space: cryptocurrency staking and yield farming. Learn how these strategies can help you earn returns on your cryptocurrency investments, understanding the risks and rewards associated with each approach. We’ll cover the fundamentals of both staking and yield farming, outlining the steps involved and helping you decide which method might be best suited for your investment portfolio.

What is Crypto Staking and How Does It Work?

Cryptocurrency staking is a process where users lock up their crypto assets in a blockchain network to validate transactions and secure the network. In return for this service, they receive rewards in the form of newly minted coins or transaction fees.

Unlike mining, which requires significant computing power, staking generally only requires holding a certain amount of cryptocurrency in a designated wallet. The specific requirements vary depending on the cryptocurrency and its consensus mechanism. Proof-of-Stake (PoS) is the most common consensus mechanism that uses staking.

The process typically involves: 1) Selecting a cryptocurrency to stake; 2) Transferring your coins to a staking wallet or exchange; 3) Locking up your coins for a specified period (often called a “locking period“); and 4) Receiving staking rewards at regular intervals, usually based on the amount staked and the network’s parameters.

Staking rewards are a form of passive income, providing a way to earn interest on your crypto holdings. However, it is important to note that the amount and frequency of rewards can vary and are subject to market conditions and network activity. Furthermore, there’s always risk involved, including the risk of smart contract vulnerabilities and price volatility.

How to Choose the Best Coins for Staking

Choosing the best coins for staking involves considering several key factors. First, assess the potential rewards offered. Higher Annual Percentage Yields (APYs) are attractive, but carefully examine the associated risks.

Next, evaluate the coin’s security and the reputation of its underlying blockchain. A robust and well-established network generally indicates lower risk. Look for coins with a strong community and active development team.

The staking mechanism itself is crucial. Understand the required lock-up periods (staking duration) and any associated penalties for early withdrawal. Consider the minimum amount required to stake, ensuring it aligns with your investment budget.

Finally, diversify your staking portfolio across different coins and protocols to mitigate risk. Don’t put all your eggs in one basket. Research thoroughly before investing and stay informed about market developments.

Understanding the Risks and Rewards of Yield Farming

Yield farming offers the potential for high returns, significantly exceeding traditional savings accounts. These returns stem from lending or staking crypto assets to decentralized finance (DeFi) protocols, earning interest or rewards in the form of platform tokens or stablecoins. The higher the APY (Annual Percentage Yield), the more lucrative the opportunity appears.

However, this high-yield potential comes with substantial risks. Impermanent loss, a phenomenon where the value of staked assets decreases compared to holding them individually, is a key concern. Smart contract risks are also significant; bugs or exploits in the underlying code can lead to the loss of funds. Furthermore, the DeFi space is still relatively new and unregulated, exposing users to greater volatility and potential scams.

Liquidity risk is another major factor. Yield farming often involves providing liquidity to decentralized exchanges (DEXs), which means your assets are locked and may be difficult to withdraw quickly, especially during market downturns. Lastly, rug pulls, where developers abscond with users’ funds, are a constant threat in the volatile world of DeFi.

Before participating in yield farming, carefully assess your risk tolerance and only invest what you can afford to lose. Thoroughly research the platforms and protocols you’re considering, understanding their mechanisms, security audits (if available), and team transparency. Diversification across multiple platforms and strategies can help mitigate some of the inherent risks.

How Decentralized Finance (DeFi) is Changing Investments

Decentralized Finance (DeFi) is revolutionizing the investment landscape by offering alternative investment vehicles outside traditional financial institutions. It leverages blockchain technology to create transparent and permissionless financial systems.

One significant change is the democratization of access to financial services. Anyone with an internet connection can participate in DeFi protocols, bypassing traditional intermediaries and their associated fees and restrictions. This opens doors to a wider range of investment opportunities for individuals globally.

Higher yields are another key attraction. DeFi platforms offer various services like staking and yield farming, which can generate significantly higher returns compared to traditional savings accounts or bonds. However, it’s crucial to remember that these higher returns often come with higher risk.

The transparency and programmability of DeFi protocols also enable innovative investment strategies and the creation of new asset classes. Smart contracts automate processes, reducing the need for human intervention and enhancing efficiency. However, smart contract vulnerabilities remain a significant risk.

In summary, DeFi is reshaping investments by offering increased accessibility, potentially higher returns, and innovative investment opportunities. However, it’s crucial to proceed with caution, understanding the inherent risks involved before engaging in DeFi activities.

The Role of Liquidity Pools in Crypto Earning

Liquidity pools are a crucial component of decentralized finance (DeFi) and play a significant role in generating passive income for cryptocurrency holders. They function by allowing users to deposit pairs of cryptocurrencies, providing liquidity for decentralized exchanges (DEXs).

In return for providing this liquidity, users earn trading fees generated from every swap conducted within the pool. The fees are distributed proportionally among the liquidity providers based on their share of the pool’s total value. The higher the trading volume in the pool, the more fees are generated and the greater the earning potential.

However, providing liquidity also carries risks. Impermanent loss is a key concern. This occurs when the relative price of the deposited assets changes significantly, resulting in a lower return compared to simply holding the assets individually. Furthermore, the possibility of smart contract vulnerabilities and rug pulls should also be considered when evaluating the viability of this income strategy.

Careful consideration of the chosen cryptocurrency pair, the pool’s trading volume, and a thorough understanding of the associated risks are essential before participating in liquidity pools to maximize potential returns while mitigating losses.

How to Secure Your Crypto Assets While Staking

Staking your cryptocurrency can offer lucrative passive income, but it also introduces security risks. Protecting your assets requires a multi-layered approach.

Firstly, choose a reputable and secure staking platform. Research thoroughly, looking for platforms with a strong track record, robust security measures (like two-factor authentication and cold storage), and transparent operational practices. Avoid lesser-known platforms with minimal oversight.

Secondly, diversify your staking across multiple platforms. This reduces your risk if one platform experiences a security breach or technical issue. Don’t put all your eggs in one basket.

Thirdly, regularly review your staking balances and transaction history. Look for any anomalies or unauthorized activity. Enable transaction notifications to receive immediate alerts of any unusual activity.

Finally, be mindful of phishing scams. Never click on suspicious links or share your private keys with anyone. Only interact with official platforms and channels.

By following these steps, you can significantly mitigate the risks associated with cryptocurrency staking and maximize your chances of earning passive income securely.

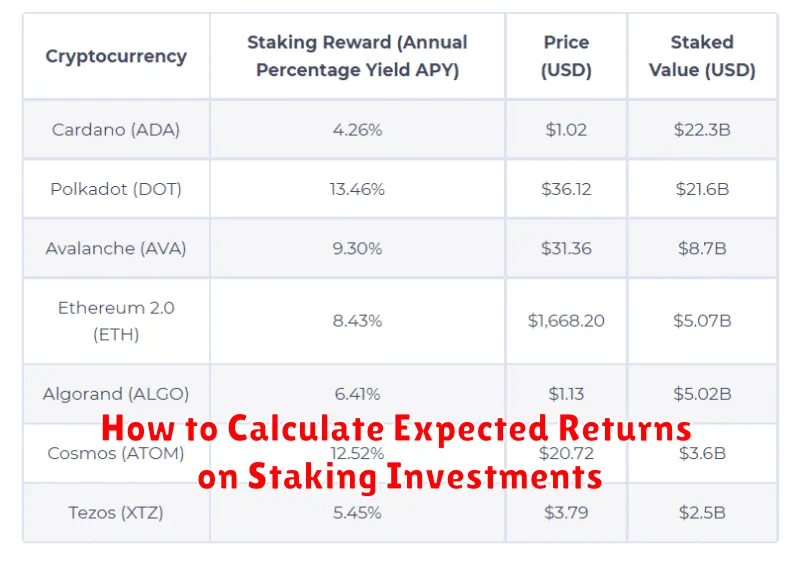

How to Calculate Expected Returns on Staking Investments

Calculating the expected return on staking investments requires understanding several key factors. First, identify the Annual Percentage Rate (APR) or Annual Percentage Yield (APY) offered by the staking pool. These rates represent the potential return on your investment over a year.

APR represents the simple interest earned, while APY accounts for compounding interest, meaning the interest earned is added to your principal, earning further interest over time. APY will generally be higher than APR.

To calculate your expected return, multiply your initial investment amount by the APR or APY. For example, if you stake $1,000 with a 5% APR, your expected annual return is $50 ($1,000 x 0.05). If the rate is APY, the calculation will reflect the compounding effect over the year resulting in a slightly higher return than APR.

It’s crucial to remember that these calculations are estimates. Actual returns may vary based on several factors, including changes in the cryptocurrency’s price, network congestion affecting rewards, and the potential for slashing penalties in some Proof-of-Stake systems.

Therefore, always factor in potential risks and volatility when assessing the expected returns on your staking investments. Never invest more than you can afford to lose.

Future Trends in Staking and Passive Crypto Income

The future of staking and passive crypto income looks promising, driven by several key trends. Increased institutional adoption is expected to significantly boost liquidity and demand for staking services, leading to higher yields and more robust infrastructure. The rise of decentralized finance (DeFi) protocols will offer more innovative and diverse staking opportunities, extending beyond Proof-of-Stake (PoS) consensus mechanisms.

Cross-chain interoperability will allow users to stake assets across different blockchains, expanding options and potentially increasing returns. This trend will be further enhanced by the development of more sophisticated liquid staking solutions, enabling users to maintain liquidity while participating in staking rewards. These improvements could lead to more accessible and user-friendly staking platforms, attracting a wider range of investors.

Improved security measures will also be crucial. As the market grows, robust security protocols will become increasingly important to mitigate risks and ensure the long-term sustainability of staking rewards. Finally, the adoption of novel consensus mechanisms beyond PoS, such as Proof-of-History or delegated Proof-of-Stake, could also introduce new staking opportunities and increase the overall efficiency and scalability of the ecosystem.