Bond investments offer a compelling avenue for investors seeking fixed-income securities. Understanding the nuances of the bond market, including interest rates, credit risk, and maturity dates, is crucial for making informed decisions. This article will explore the fundamentals of bond investing, equipping you with the knowledge to assess bond yields, manage portfolio risk, and potentially achieve your financial goals through fixed-income strategies.

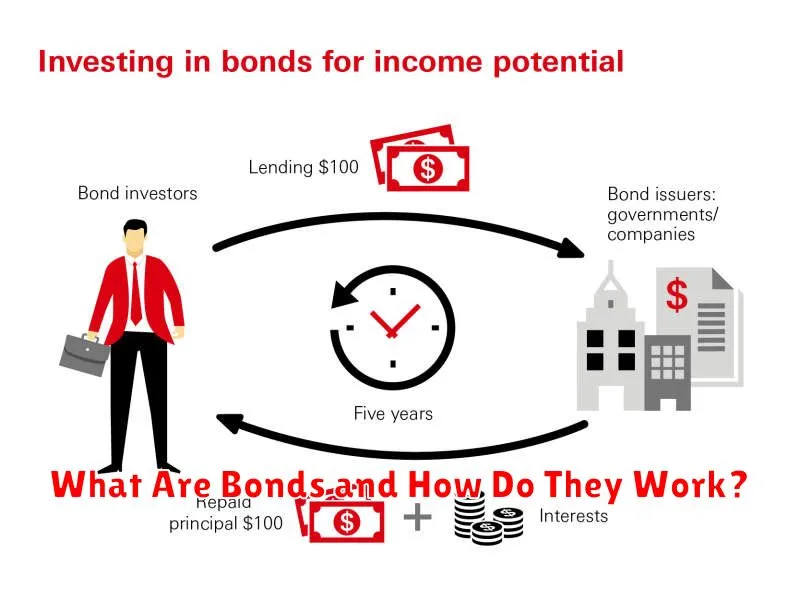

What Are Bonds and How Do They Work?

Bonds are a type of fixed-income security, essentially a loan you make to a government or corporation. When you buy a bond, you’re lending them money for a specified period, called the maturity date.

In return for your loan, the issuer agrees to pay you interest at a fixed rate (coupon rate) over the life of the bond. This interest is typically paid semi-annually. At maturity, the issuer repays the principal (the original amount you lent).

Bond prices fluctuate based on various factors, including interest rates. If interest rates rise, the value of existing bonds may fall, and vice versa. This is because new bonds issued at higher rates become more attractive.

Bonds are considered relatively lower-risk investments compared to stocks, but they still carry some level of risk, such as default risk (the issuer failing to repay the principal or interest).

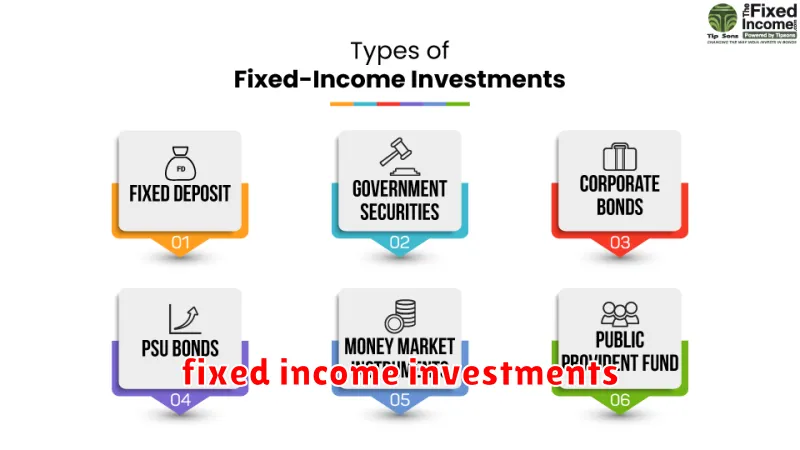

Different Types of Bonds Explained

Bonds are essentially loans you make to a government or corporation. In return, they pay you interest over a set period and repay the principal (the original amount loaned) at maturity.

Several types of bonds exist, each with varying characteristics: Government bonds, issued by national or local governments, are generally considered low-risk but offer lower yields compared to corporate bonds. Corporate bonds, issued by companies, offer potentially higher yields but carry higher risk. Municipal bonds, issued by state or local governments, often offer tax advantages.

Treasury bonds are a specific type of government bond issued by the U.S. Treasury, known for their low risk. Agency bonds are issued by government-sponsored enterprises (GSEs), like Fannie Mae or Freddie Mac. High-yield bonds (also called junk bonds) are corporate bonds with higher risk and higher potential yields due to the issuer’s lower credit rating.

Other bond types include convertible bonds (which can be converted into stock), callable bonds (which can be redeemed early by the issuer), and zero-coupon bonds (which don’t pay periodic interest but are sold at a discount to their face value).

Understanding the different types of bonds is crucial for making informed investment decisions, balancing risk and return according to your individual financial goals and risk tolerance.

How to Assess Bond Risks and Returns

Assessing bond risks and returns requires a multifaceted approach. Yield, a key return metric, represents the income generated relative to the bond’s price. Higher yields generally suggest higher risk, but this isn’t always the case. Careful consideration of the issuer’s creditworthiness is crucial. Credit rating agencies provide assessments (e.g., AAA, BBB, etc.), indicating the likelihood of repayment. Lower ratings signify greater default risk – the possibility the issuer fails to make timely payments.

Interest rate risk is another significant factor. Bond prices move inversely with interest rates; rising rates decrease bond prices. The duration of a bond measures its sensitivity to interest rate changes; longer duration means greater sensitivity. Inflation risk, the erosion of purchasing power due to rising prices, also impacts returns. Bonds with inflation-protected features can mitigate this risk. Reinvestment risk involves the uncertainty of reinvesting coupon payments at favorable rates.

Liquidity risk concerns the ease of selling a bond before maturity. Actively traded bonds offer higher liquidity. Finally, call risk applies to callable bonds, where the issuer can redeem the bond before maturity, potentially at an unfavorable time for the investor. A comprehensive analysis of these risks, coupled with a thorough understanding of the bond’s yield, allows investors to make informed decisions about their fixed-income investments.

Government Bonds vs Corporate Bonds: Key Differences

Government bonds, issued by national governments, are generally considered less risky than corporate bonds, issued by companies. This is because governments have the power to tax and print money to meet their debt obligations, reducing the likelihood of default. Government bonds typically offer lower yields than corporate bonds to reflect this lower risk.

Corporate bonds, on the other hand, carry a higher degree of risk. The risk of default is greater, as a company’s financial health can fluctuate. To compensate investors for this increased risk, corporate bonds usually offer higher yields than government bonds.

Another key difference lies in taxation. The interest earned on some government bonds may be exempt from certain taxes, while interest on corporate bonds is generally taxable.

Finally, liquidity can vary. Government bonds, particularly those issued by larger economies, are often more liquid and easier to buy and sell than corporate bonds, especially those issued by smaller or less well-known companies.

How Interest Rates Impact Bond Prices

Bond prices and interest rates share an inverse relationship. This means that when interest rates rise, bond prices generally fall, and vice versa.

When a bond is issued, it offers a fixed coupon rate. If market interest rates subsequently increase, newly issued bonds will offer higher yields. This makes existing bonds with lower coupon rates less attractive, leading to a decrease in their market price to compensate for the lower yield.

Conversely, if market interest rates decline, newly issued bonds will offer lower yields. Existing bonds with higher coupon rates become more attractive, driving up their market price.

The maturity date of a bond also plays a role. Longer-term bonds are more sensitive to interest rate changes than shorter-term bonds. A small change in interest rates will have a larger impact on the price of a long-term bond compared to a short-term bond.

Therefore, understanding the relationship between interest rates and bond prices is crucial for effective bond investing. Investors need to consider the potential impact of interest rate fluctuations on their portfolio’s value.

Strategies for Building a Bond Portfolio

Building a successful bond portfolio requires a well-defined strategy tailored to your risk tolerance, investment goals, and time horizon. Several key strategies can be employed.

A laddering strategy involves purchasing bonds with varying maturities, creating a staggered maturity schedule. This approach provides a steady stream of income and reduces interest rate risk. As bonds mature, the proceeds can be reinvested at prevailing rates.

Diversification is crucial. Spreading investments across different bond types (e.g., government, corporate, municipal), issuers, and maturities minimizes risk. Consider diversifying by credit quality as well, balancing lower-yielding, higher-quality bonds with potentially higher-yielding, higher-risk bonds.

Barbell strategy focuses on allocating funds to both short-term and long-term bonds, minimizing interest rate risk while still benefiting from higher yields of long-term bonds. This strategy balances liquidity with potential returns.

Bullet strategy involves concentrating investments in bonds with a similar maturity date. While simpler than other strategies, it exposes the portfolio to higher interest rate risk if the bonds are held to maturity.

Active management involves actively trading bonds based on market conditions and predictions. This requires significant market expertise and time commitment. Passive management, conversely, involves a buy-and-hold strategy, requiring less active monitoring.

The optimal strategy depends on individual circumstances. Consider consulting a financial advisor to determine the most appropriate strategy for your specific needs and risk profile. Regular portfolio review and rebalancing are essential for maintaining a well-diversified and effective bond portfolio.

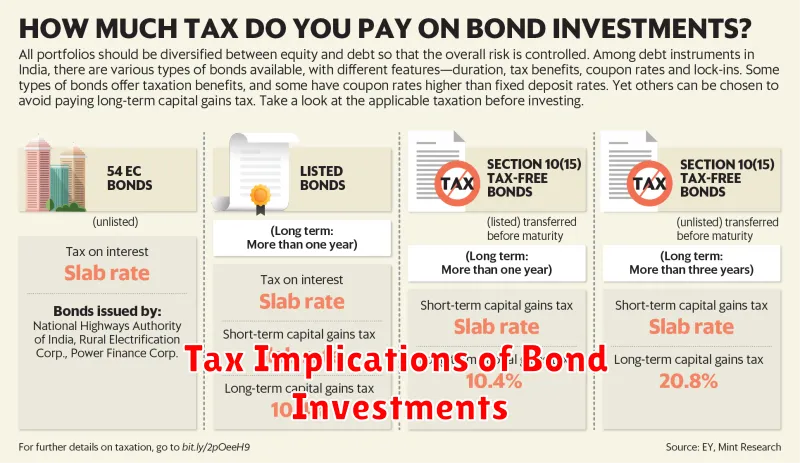

Tax Implications of Bond Investments

Understanding the tax implications of bond investments is crucial for maximizing returns. The tax treatment of bond income varies depending on the type of bond and your investment strategy.

Interest income from most bonds is considered taxable ordinary income at the federal level, and in many cases, at the state and local levels as well. This means it’s taxed at your individual income tax rate. The amount of interest you receive will be reported to you on a 1099-INT form.

Municipal bonds, issued by state and local governments, often offer tax-exempt interest at the federal level. However, it’s essential to note that interest on municipal bonds may still be subject to state and local taxes, depending on your residence and the issuer of the bond. The tax-exempt nature of municipal bonds can make them particularly attractive to investors in higher tax brackets.

Capital gains are realized when you sell a bond for more than you paid for it. These gains are generally taxed at the lower long-term capital gains rates if the bond was held for more than one year. Conversely, selling a bond for less than its purchase price will result in a capital loss, which can be used to offset capital gains.

Treasury bonds issued by the U.S. government are generally exempt from state and local taxes, although the interest earned is taxable at the federal level. The specific tax implications can be complex, therefore seeking professional financial advice is recommended to fully understand the nuances of tax treatment for different bond investments and how they align with your individual financial situation.

Best Practices for Long-Term Bond Investing

Long-term bond investing offers the potential for higher returns but also carries increased risk. Diversification across issuers, maturities, and sectors is crucial to mitigate risk. Consider a mix of government, corporate, and potentially municipal bonds to achieve a balanced portfolio.

Dollar-cost averaging is a valuable strategy. Instead of investing a lump sum, spread your investments over time to reduce the impact of market volatility. This helps avoid buying high and selling low.

Maturity matching your investment horizon is vital. If you need the money within a specific timeframe, align your bond maturities accordingly to minimize interest rate risk. For long-term goals, longer-term bonds might be suitable, but with a caveat to manage duration risk effectively.

Regularly rebalance your portfolio. Market fluctuations can shift the asset allocation away from your target. Rebalancing involves selling some higher-performing bonds and buying underperforming ones to maintain your desired asset mix and risk profile.

Understand the risks inherent in bond investing. Interest rate risk, inflation risk, and credit risk are all factors to consider. Conduct thorough due diligence before investing in any bond, paying close attention to the issuer’s creditworthiness and the bond’s terms.

Seek professional advice if needed. A financial advisor can help you develop a personalized bond investment strategy that aligns with your financial goals, risk tolerance, and time horizon. They can also assist in navigating the complexities of the bond market.